Many Singaporeans make this mistake when saving up for their child’s university education. Are you doing it too?

Retirement planning, Wealth preservation, Investment, children's education • 2023-01-19

If you have children, there will be a time in your late 40-50s when you face two major milestones:

- Your impending retirement

- Your children’s tertiary education

As parents, you might feel it’s your responsibility to fund your children’s education all the way till tertiary education.

Education is an expensive affair and usually, it requires a few upfront payments.

For some of you, it might be challenging to save for your children’s education and your retirement at the same time.

Many of my clients usually opt for prioritising the latter.

But if you don’t have enough in your retirement years, it can spell potential financial burdens that your children would have to bear.

Some of you might feel that you can probably just retire later or depend on your kids when you finally stop working.

How realistic would this be?

I have seen many of my clients making this mistake.

If your children are of university age, you need to be very strategic in your financial planning.

Let me dissect these below.

Already have education savings plans? Why can’t you retire earlier?

Endowment plans might not be enough

Some people in their younger days might have bought savings plans, endowment plans or other investment plans for their children’s education.

For illustration purposes, I compared the difference in costs for a law degree at the National University of Singapore (NUS) in 2009 versus 2022.

Back in 2009, the annual tuition cost for a law degree was $6,100.

Fast forward to 2022, it costs $12,700. The increase in price just after 3 years is a whopping 108%!

So if you bought your endowment/investment plans many decades ago, you might want to review them and assess if they are really still enough to cover your children’s educational expenses.

On top of university fees, other expenses like costs of living and course materials would increase over time due to inflation too.

If you are considering sending the kids overseas, the costs would be much more.

Typically, many parents would usually try to cover these additional expenses with their own savings.

After all, you are still working – should be okay right?

This was what one of my friends, Jack (not his real name) did. Let me share with you his story.

What happens when you choose your children’s education over your retirement?

Jack invested most of his money in his two children – meaning in their education, expenses, etc.

By the time he reached retirement age, there wasn’t much left for him and his wife to retire.

So he worked for a few years longer.

But little did he know, a few years down the road, his pre-existing diabetes took the best of him.

He has not been the same ever since.

He was not able to work like he used to.

His monthly expenses also increased due to his medical care.

Due to his health, he had no choice but to retire earlier than he wished. His two children (who were working adults by then) supported his expenses on top of his CPF LIFE payouts.

Around the same time, his wife retired as well. Similarly, his wife channelled most of her savings to support their children’s education expenses. Long story short, she had $400,000 for her retirement.

Jack on the other hand was left with $300,000 in savings. They have a solid $700,000 nest egg.

Unfortunately, as life would have it, Jack required extra care for the long term.

He had to go through more medical procedures over time.

Unfortunately, his wife’s health worsened as well and she also required long-term care.

Thus, the couple needed to outsource caregiving.

Both of them were initially not aware of how long-term care costs could eat away at their retirement nest egg.

With recurring monthly expenses of $4,000 ($2,000 per person), and additional medical/long-term care costs of about $1,870 for both of them (after CareShield Life subsidies), Jack and his wife could only get by for 9 years, comfortably.

And he realised that for the next 12 years at least (assuming they both live until 85 years old), his children have to support their expenses.

If the family incurred any unexpected emergency expenses, their nest egg would deplete even more quickly.

Jack’s situation is common among us Singaporeans.

By the time your children are able to support you financially, they might be building their own families too.

How realistic would it be to burden them for more than a decade?

Is it too late to prioritise your retirement in your 50s?

Some of you might feel that it is too late to prepare for your retirement. Especially when you have a shorter investment time horizon compared to the younger folks.

But I’m here to assure you that it is definitely still possible, as long as you are willing to relook at your entire retirement portfolio holistically.

You can still build multiple passive income streams to support your financial needs, whether for your children or your own, in the near term.

This way, you are able to provide for your family and enjoy your retirement nest egg at the same time. You don’t have to give up your retirement for their education needs.

For those who are retiring soon, it is not too late to revamp and restructure your retirement portfolio into an income-generating portfolio.

How are your assets contributing to your retirement income?

Many of my clients are asset-rich but their assets are not optimised to provide them with the passive income they need to retire.

This is why it is important to review and analyse your current portfolio regularly.

Are there any under-optimised assets?

Sometimes, it could be just a matter of channelling your existing assets into the right income-generating assets to potentially build financially stable retirement years for you.

I help many of my clients optimise their retirement nest eggs this way, using a wealth-optimisation framework:

That is why, for my clients, holistic retirement planning will be incorporated for a seamless experience in getting your finances on track, for you and your family.

Many of my clients are mass affluent pre-retirees and retirees. Those who are already retiring are doing so comfortably with the regular passive income they are looking for. Those who are retiring soon are on track to retire earlier than planned.

With my 8 years of experience working with more than 100 mass affluent families to potentially retire 10-15 years earlier, I will be able to help you do the same.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

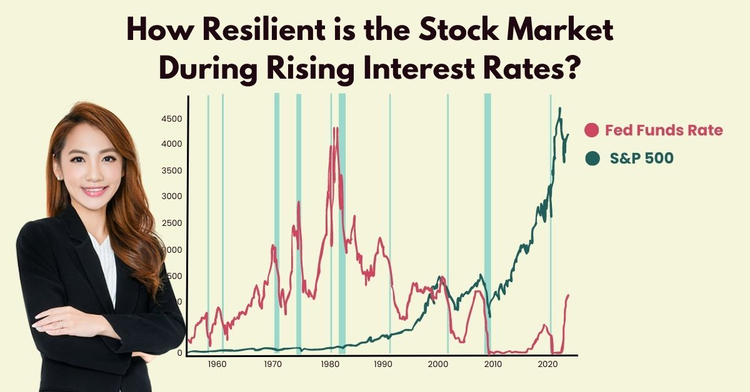

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.