Is your retirement fund enough with this unexpected cost?

Retirement planning, Long term care • 2022-05-30

Imagine this.

You are at the point of your life where financially you are stable, your children are all married and living on their own, and you are now happily retired with your spouse.

To sit back and relax after long working years to make ends meet and more. You are able to provide a life you never had to your family.

Until one day...

“Honey... I can’t feel my face and my arm feel so heavy...”, said your wife before she fainted on the floor.

And the rest was history.

She suffered from a stroke which paralysed the whole right side of her body, permanently.

And now she needed long-term care. She’s unable to carry out daily activities on her own.

And although you have prepared a financial plan for your retirement, you missed the possibility of requiring long-term care in your retirement years.

Everything changed.

Everything has gotten more expensive.

And now you are back to finding the means to provide long-term care for your wife because whatever you prepared was simply not enough...

Don’t let this happen to you. You can do something about it, from today.

When we are approaching our 50s or 60s, we hear more and more instances that our peers are getting diagnosed with chronic illnesses like cancer, diabetes, and many other health problems.

It is a period where health scares are becoming more common.

One day it’s your close friend, the next it could be your spouse. And possibly, you too.

So what can you do?

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Medical care costs for old age are just the tip of the iceberg

When planning for retirement, people tend to project how much they would need based on current expenses and adjust accordingly to their expected lifestyle in the future. But most of the time, many people miss incorporating potential long term care costs into the equation.

How much does it cost to hire a private nurse?

What if a family member needs to stop working as a caregiver? That would be a loss of income for the person.

Are you able to support the financial burden when you reach this point in your life?

These costs can have a significant impact on individuals and often also other family members who are willing to support the costs.

It all stems from failing to incorporate this important factor — long term care costs — which eventually result in faster depletion of your retirement funds and transfer the burden to your children.

Now, we don’t want this to happen to the next generation, do we?

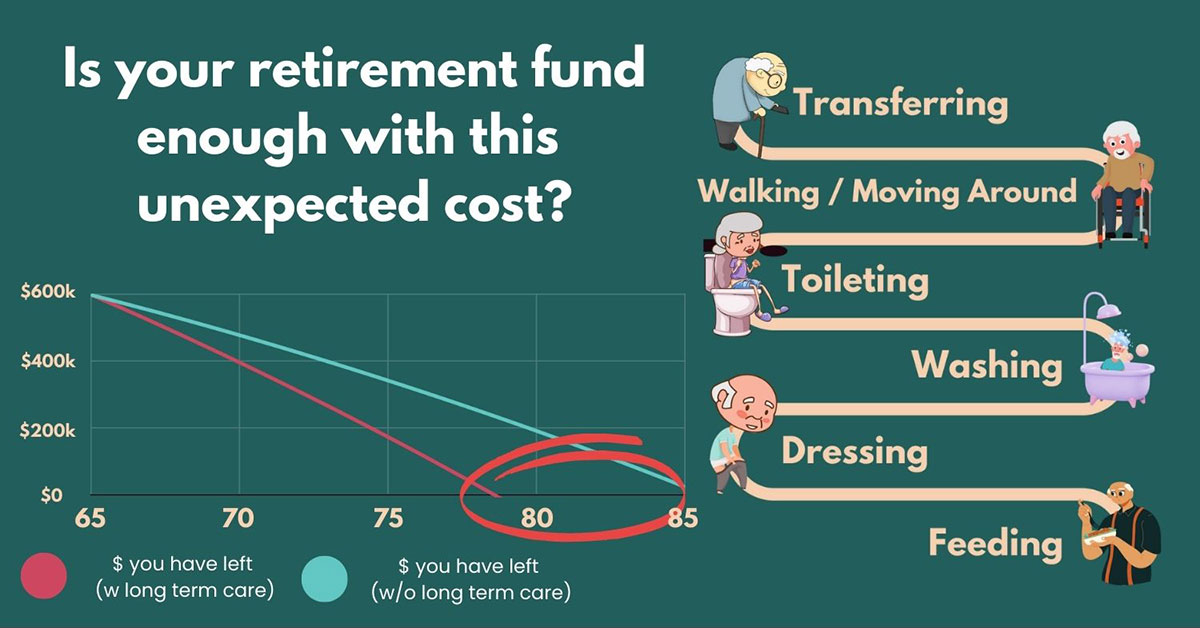

The older you get, the higher the possibility of needing assistance for daily activities. It is important to know what long term care comprises. You might need to get assistance in:

- Personal care (i.e. bathing and dressing)

- Cleaning the house

- Preparing nutritious meals

- Transportation to health appointments and other places

- Ensure medicines are consumed as prescribed

So these are the considerations you need to take into account for your long term care. How to prepare for this can be a complicated subject to analyse and strategise for.

How would you prepare for something you are unsure of?

As long term care costs vary among individuals, professionals such as Financial Adviser Representatives (FARs) are able to provide insights on how these costs can be planned and managed for your retirement.

Start planning for your retirement that is inclusive of these variable costs. This way, you don’t only retire confidently but also potentially generate enough wealth so you will not burden your future generation.

Medical care is more expensive now. Is your ElderShield or CareShield Life enough?

With inflation and an increasingly ageing population in Singapore, the increase in medical costs is inevitable.

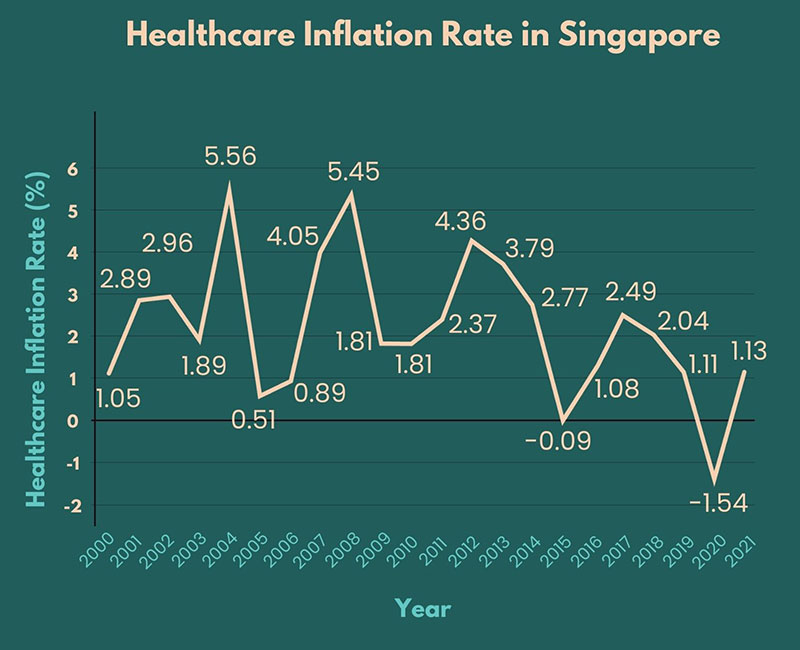

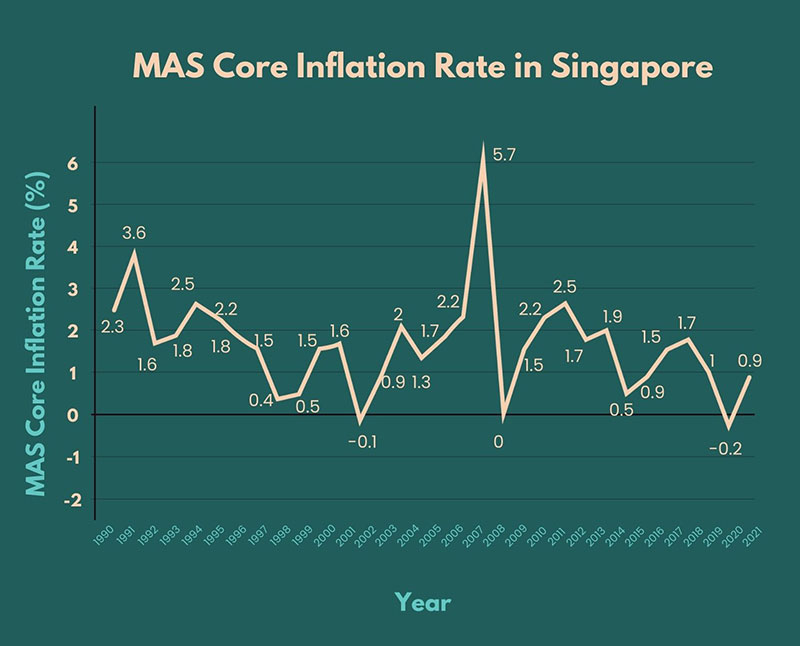

Source: Singapore Department of Statistics

Source: Singapore Department of Statistics

From the graphs above, you can see that the rising cost of healthcare is outpacing the rising cost of living in Singapore.

You might spend a huge amount of money on healthcare itself like surgeries, medical consultations and procedures. With that said, will you have enough for the costs of long term care?

Besides long-term care insurance provided under ElderShield or CareShield Life, you may also need enhanced solutions to address your long-term care costs.

A study in 2022 showed that each senior in Singapore will likely need an average of $1,900/month for long term care costs alone. Imagine multiplying this by years or even decades.

Here is an example for better illustration:

- You are 40 years old in 2022 (enrolled in CareShield Life in 2020).

- You made a successful claim in 25 years’ time (you will be 65 years old then).

- Such, assuming CareShield’s payouts continue to increase 2% up until 25 years later, the monthly payouts that you’re entitled to will be about $965. When claimed, the payouts will remain fixed as long as you are severely disabled.

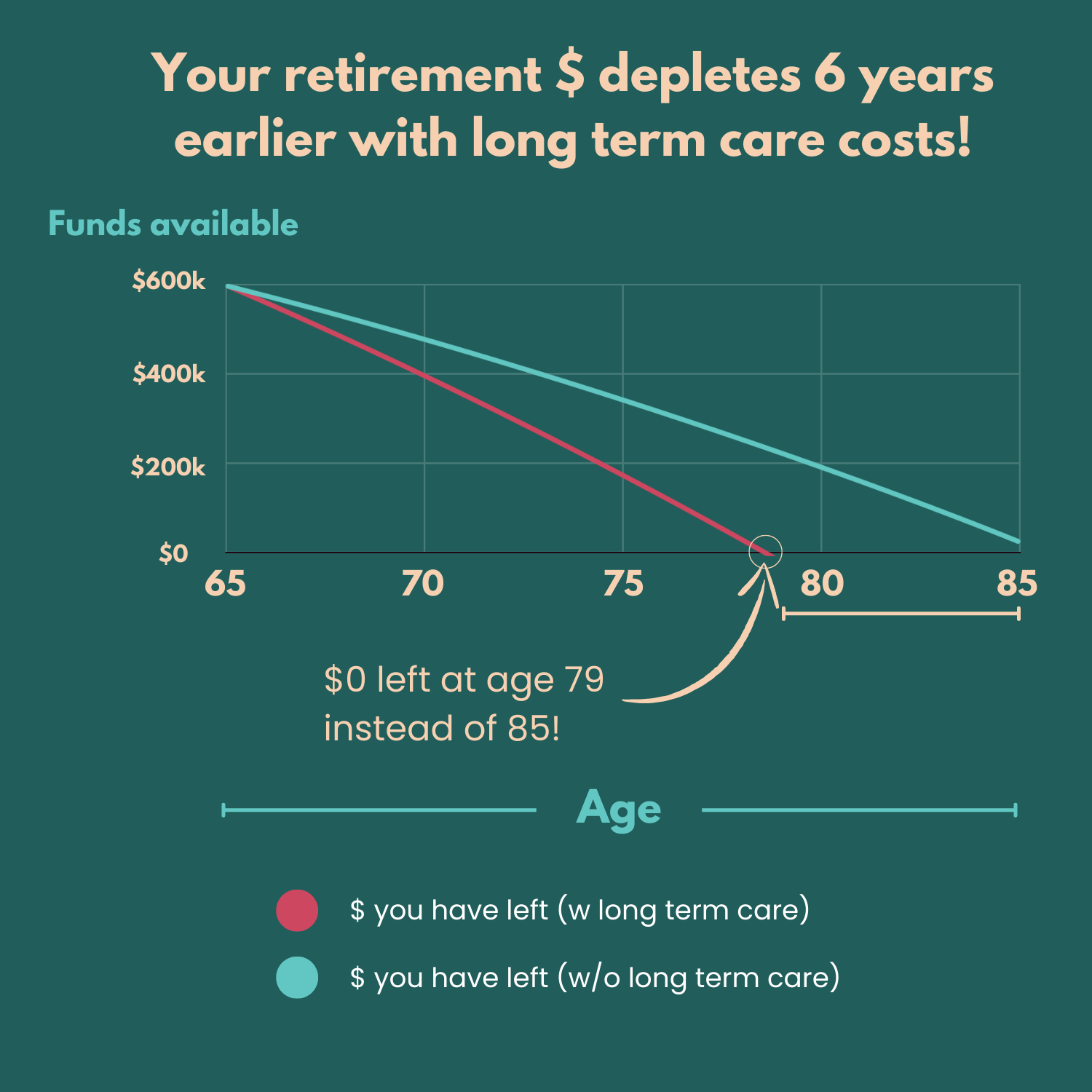

- You have $600,000 worth of retirement funds with expenses of $2,000/month.

If you are fortunate and don’t require long term care, your retirement funds may last you up to 85 years old.

But if you fall ill and require long term care, you might need to spend up to $1,900 more a month.

With the support of $965/month payout from CareShield Life and factoring in 2% inflation (for calculation purposes), this $600,000 can only last you up until 79 years old.

(Note: If you are enrolled under ElderShield, your monthly payouts would be $300 or $400 per month, for up to 72 months, depending on when you joined ElderShield.)

Have you considered what happens after you have depleted your retirement funds?

If you opted for the CPF Life payouts, you will still have some income for a lifetime. But is that amount enough for you to cover your basic needs as well as long term care costs?

You might need to depend on your family on top of this.

This can cause a huge financial strain on your family members.

Long-term care is not just for yourself, but it is to ease the burden on your caregiver as well.

Caregiving is a 24-hour, 7 days a week job.

It would be physically and emotionally challenging.

Financially, it will surely be draining.

Take the time to consult with an experienced Financial Adviser Representative (FAR) who has the skills and expertise in planning for your retirement with a holistic approach – which includes retirement risk factors such as the need for long term care. Strategise your retirement planning that includes long term care costs now →

What you can do?

If you are retiring soon, here are some simple steps you can do to prepare yourself in case you need long term care.

1. Understand your resources and potential costs

Since Singaporeans have access to ElderShield or CareShield Life, both of which are long-term care insurance, find out what your current plan covers and assess if it is enough for you.

- What are the benefits of the policy?

- Will you need to supplement that coverage with your own money?

- If so, how do you plan to supplement the insurance policy?

- Is the maximum claimable amount realistically enough for you?

This way, you will have a clearer picture of how much money is available for you to ease your financial burden.

And from here, how much more do you need to take out of your own pocket?

Estimating long term care costs can be a tricky job to do.

It is hard to plan for something if we don’t know what your potential needs might be.

But you can estimate based on realistic, basic expectations.

- Do you prefer home-based care or move into a facility?

- How do you plan to go to healthcare appointments?

- Do you foresee the need to hire a caregiver?

If you expect a family member to help care for you, it is best to have the discussion in advance.

Don't take for granted that your children or other relatives will be willing or able to fill this role.

On top of that, you should not assume that the care should be done for free.

Your potential caregiver might need to give up their job to care for you. This will cause a huge implication for you and your family, financially.

At least by planning ahead, you are prepared for some basic needs.

2. Put your money where it grows

It is inevitable that we will eventually grow old. And as we age, our body ages too.

And as we reach an older age, we are more susceptible to illness. Some of you might have already felt it – your friends or family around you might have fallen ill and require lots of medical care or long term care.

So if this happens to us, we need to be prepared to face it, financially.

Comprehensive retirement planning is needed for you to plan ahead so you can potentially retire confidently and eventually, comfortably.

It is important for us to grow our wealth through different assets so that they are able to generate sufficient income for our retirement life which includes potential long term care.

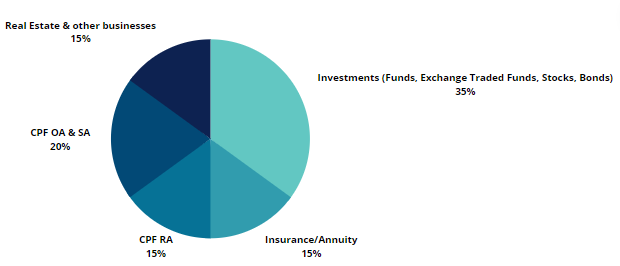

For illustration purposes, this is what I mean by putting your money where it grows. Below is an example of one of my client’s retirement portfolios:

For illustration purposes only. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Through this allocation, she is currently on track to potentially earn up to $6,000 monthly in passive income.

This mix of assets is tailored and strategised accordingly to her net worth, financial goals and risk appetite in investing. Her family’s medical history and health conditions have also been taken into consideration and insurance for sufficient protection is also in place.

Her passive income was carefully calculated so she is able to live comfortably should she require long term care in the future.

An experienced FAR can guide you at every step – so that you can potentially achieve your retirement goals and help you navigate through the many health and long term care insurance policies so that you can be sufficiently protected with a peace of mind upon retirement.

Just as you consult a doctor for a healthy life, you should do the same to consult experts in your financial planning.

Many of my clients are mass affluent pre-retirees or are already retiring. Those who are already retiring are doing so comfortably with the regular passive income they want.

Those who are retiring soon are on track to retire earlier than planned.

With my 8 years of experience working with more than 100 mass affluent families to potentially retire 10-15 years earlier, I will be able to help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

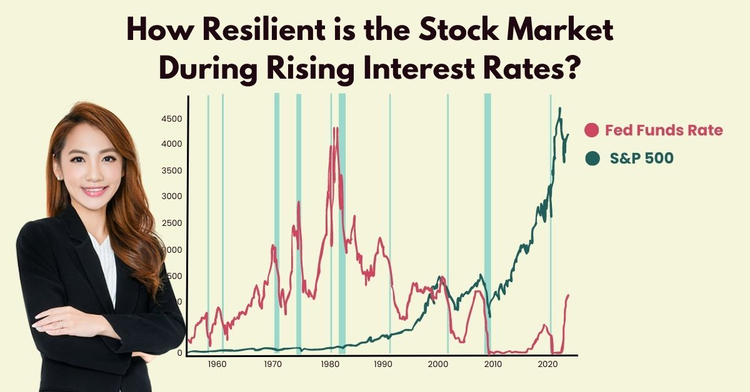

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.