Will AI follow the footsteps of the dotcom bubble? What are the risks right now?

Investment • 2024-05-20

With the emergence of AI technologies like ChatGPT, Midjourney and others, there has been a surge in breakthroughs in content creation and programming over the past year.

Some of you might have felt the impact of this AI euphoria, and you might be asking, “How can I jump onto this ship before it reaches its high?”

However, what if this is just another bubble that may burst?

What we are experiencing with AI now is similar to what the previous generations went through during the dotcom era.

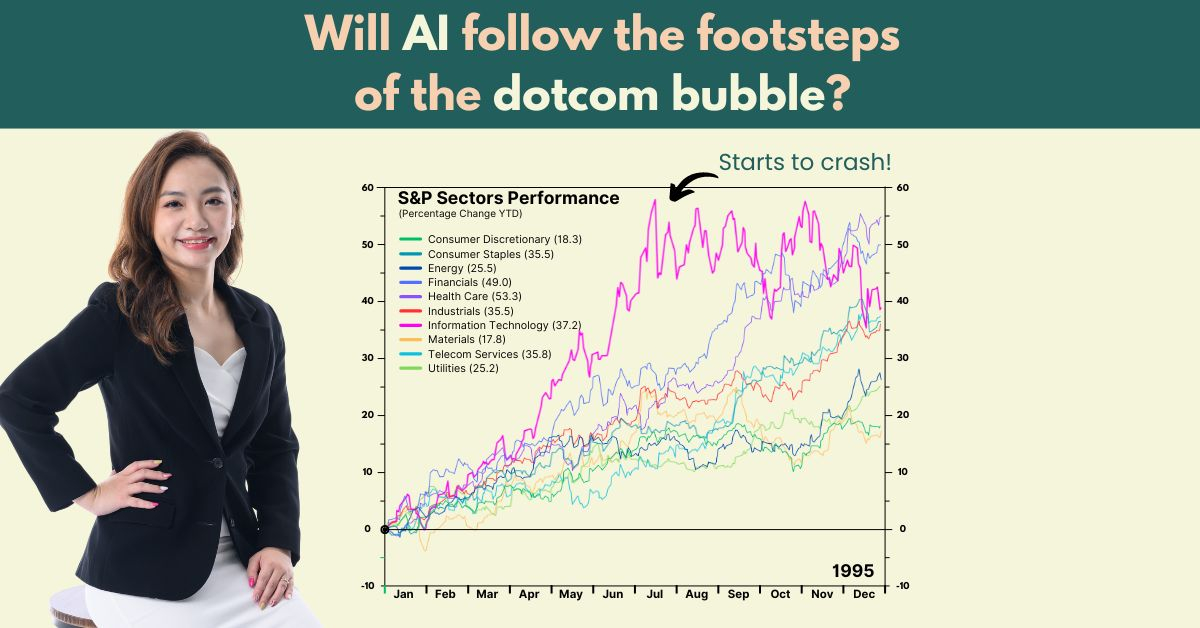

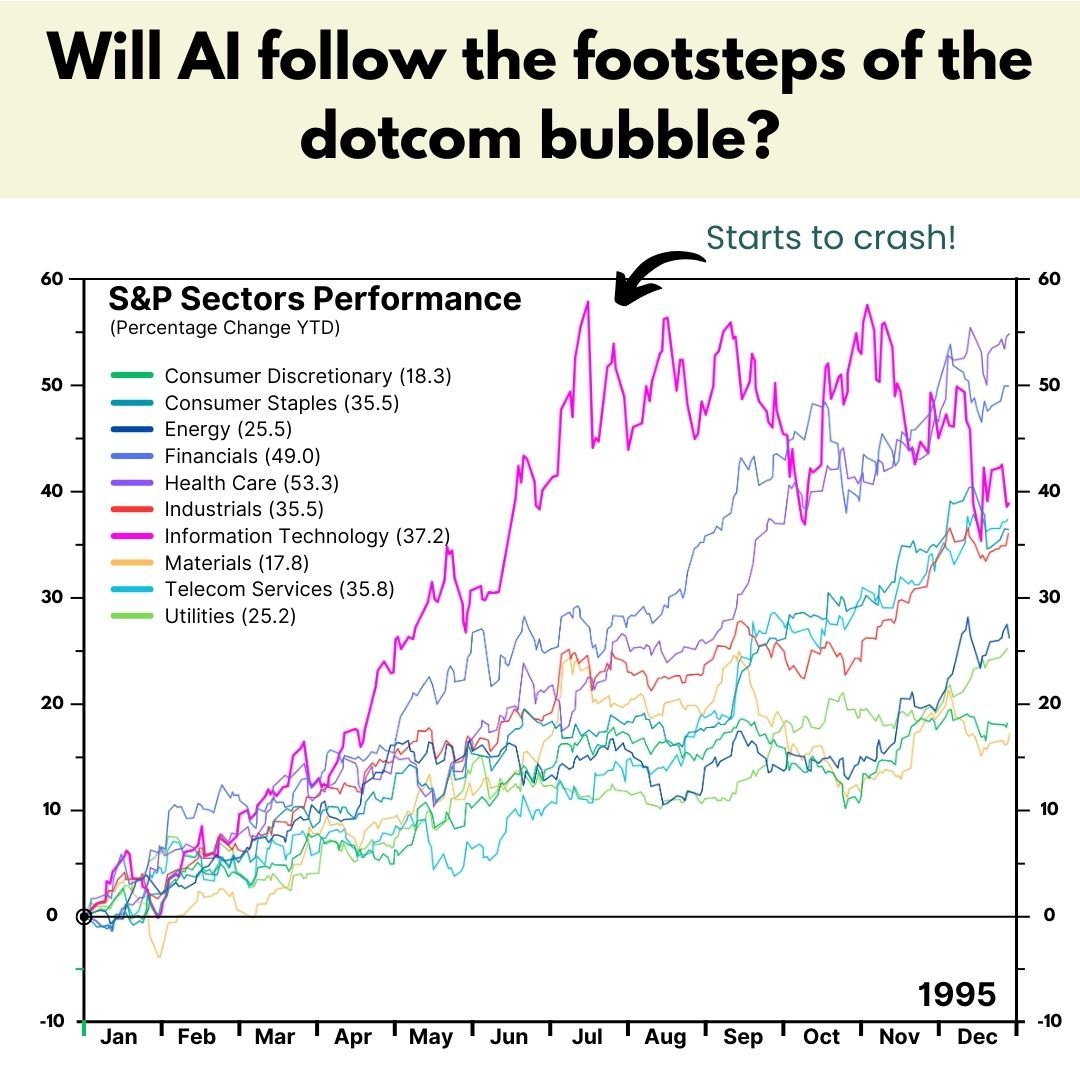

In the first half of 1995, internet services and the World Wide Web saw significant advancements, leading to a 60% growth in the Information and Technology sector.

Similarly, today, the entry of major tech giants like Microsoft, Google, Apple and Meta into the AI sphere last year led to a surge in NASDAQ.

At that time, Netscape, a computer services company best known for its web browser, Navigator, grew in popularity and its stock prices soared.

Navigator, alongside Microsoft’s Internet Explorer (IE), was one of the two most popular web browsers in the 1990s.

When Netscape successfully IPO-ed in 1995, its stock prices soared by 108%, rising by another 200% just 3 months later.

Despite this remarkable growth, the company had not yet achieved profitability. Nevertheless, their success paved the way for other web companies to go public, even before turning a profit.

But in the second half of 1995, tech stocks started to crash due to the competitive landscape.

Companies struggled to retain users due to the competition, which led to reduced margins.

Web application companies, in particular, experienced rapid growth and subsequent crashes compared to companies with a stronger foundation.

Netscape also subsequently went bankrupt.

Image source: Yardeni.com

The current AI euphoria we are witnessing now resembles the euphoria investors experienced with Netscape during the dotcom era.

After the initial high, investors typically become more rational. At this point, they might realistically assess the performance and profitability of these companies.

And this is when the market might correct itself, similar with SNOW and Adobe earlier this year when prices fell.

Ultimately, if you are planning to invest in companies vested in AI, you will need to understand if you want to be in it for short-term gains or long-term prospects.

Large tech companies with strong foundations are generally less risky in the long term.

And while the AI bubble may be inevitable, as long as we stay focused on our long-term goals, we will be able to manage its impact while capitalising on suitable opportunities.

As a Chartered Financial Consultant (ChFC®) recognised among the top 1% in the financial services industry, I continually stay ahead of market trends and opportunities while effectively managing the risks involved.

Over the past 9 years, I have been helping mass affluent pre-retirees in growing and preserving their wealth, so that they are on track to retiring comfortably with stable lifetime payouts.

Additionally, some clients were able to enhance their wealth, leaving a lasting legacy for their future generations, even amidst economic uncertainty.

if you are keen to find out how you can capitalise on today’s opportunities and preserve your wealth sustainably in today’s market, simply reach out to me through this short application here.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.