How can you reduce taxes while growing your retirement funds?

reduce taxes, Retirement planning, Investment, SRS • 2024-12-15

How can you reduce taxes while growing your retirement funds?

If you are searching for ways to reduce your taxes this season, why not do so while growing your retirement fund at the same time?

Topping up your SRS and strategising your SRS investments could kill two birds with one stone.

Some of you might be aware that if you withdraw from your SRS account on or after your statutory retirement age (which is age 63 as at 2024), only 50% of the withdrawn amount will be added to chargeable income.

You can even strategise your withdrawals to reduce tax liability.

For example, if you withdraw $40,000 from your SRS, the taxable amount is $20,000.

Assuming no other income sources, the first $20,000 of your chargeable income would not be taxed, which means your tax liability would be $0.

Even if you withdraw $80,000 from your SRS, since only 50% of the withdrawn amount is subject to taxes, your gross tax payable would be still small at $350 (assuming no other income sources).

To grow your retirement fund, you can invest your SRS monies in various SRS-approved investment instruments available, and right now, we are offering a few opportunities for you to both save taxes and grow your retirement monies:

You can save up to $3,060 in taxes and receive annualised 10% p.a. returns on an SRS-approved fund.

For cash investments, we are offering everyone an exclusive opportunity to invest in accredited investor funds with annualised 14.8% returns.

Find out more and reach out to me here.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

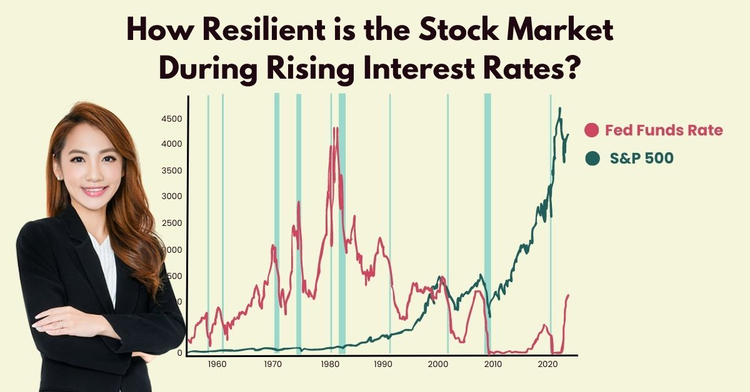

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.