Bonds, REITs or Gold: Can these defensive assets really preserve your money in a volatile market?

Wealth preservation, income investing, Passive income, Investment • 2022-07-04

Inflation and interest rates are sky-rocketing, while recession talks are popular these days.

It can be really scary when this is the time you intend to retire.

Are you considering retiring soon?

Is the current economy making you have second thoughts to do so?

With inflation at an all-time high, how do you possibly grow your money when the market is in the RED…

The situation seems to be a lose-lose case.

You invest, you lose money from the market volatility.

But if you don’t do anything to preserve your wealth, you lose money to inflation.

As such, to at least preserve your capital, you have probably begun your investment journey by opting to invest in defensive assets. These assets are instruments that can potentially get more stable returns such as high-grade bonds.

Does this sound like you?

However, will these assets really help to preserve your capital? To what extent do they do so?

Let’s take a look at some popular defensive assets many Singaporeans use to preserve their wealth.

At The Fin Lens, I help my mass affluent clients invest and build multigenerational wealth so they can retire earlier and leave a legacy for their children. Start mapping your 6-figure retirement plan now.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Can bonds preserve your wealth with high inflation and rising interest rates?

It is understandable to assume that bonds are generally safer financial instruments to invest in compared to equities. Especially if you are investing in high-quality bonds such as government bonds and bonds with high credit ratings.

And for such bonds, the bond payments are generally not as vulnerable to market volatility as compared to higher-risk instruments.

This is because bond payments are debt obligations to the issuer. So the risk of not getting paid lies in the credit risk of the issuer instead of the volatility of the market alone.

But, if the company’s ability to meet its debt obligations is affected by the volatility of the market, there is still the risk of non-payment from bond investments.

While many of us are fixated on the risk of default in bonds, in high inflation and rising interest rate environment, your bond investment might also be affected negatively.

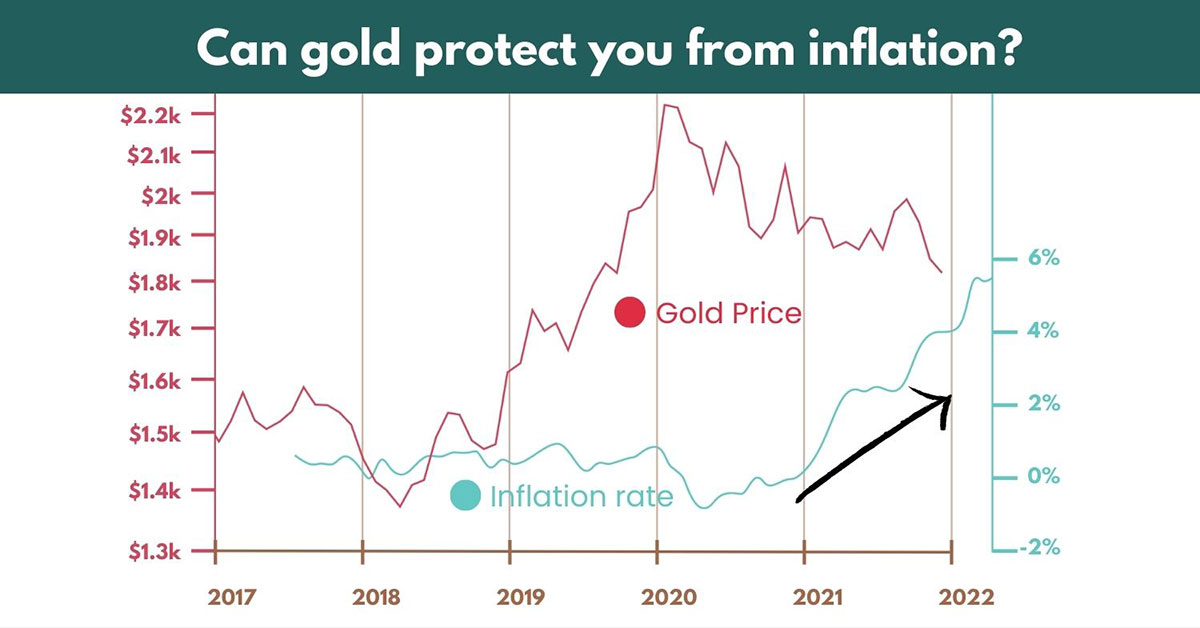

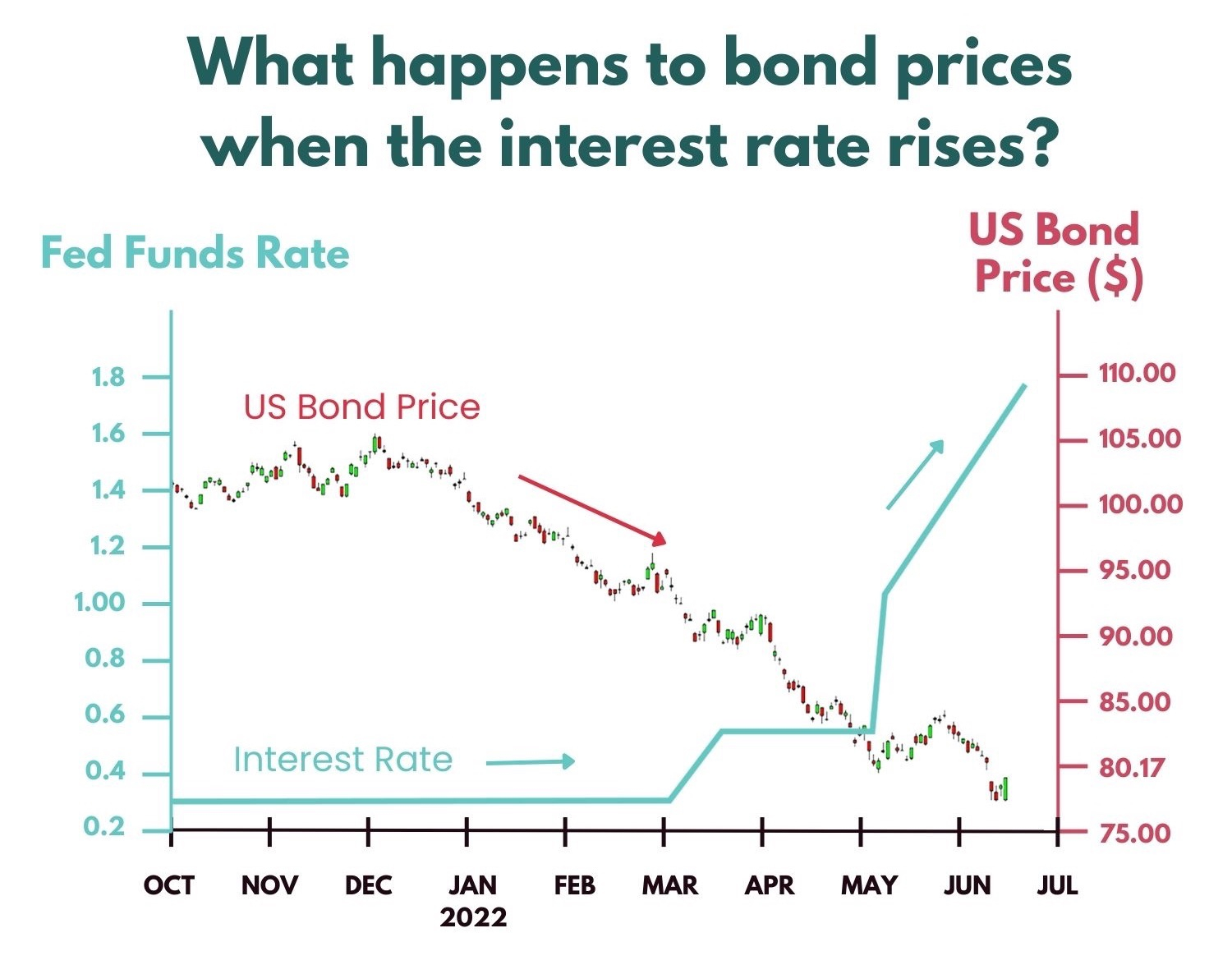

Data source: Finviz.com, tradingeconomics.com

The graph above shows the relationship between the price of a US long-term bond fund and the Fed funds rate (US interest rate).

Are you seeing an inverse relationship?

What does this relationship mean to you?

More on this in the sections below.

Can bond income beat current high inflation?

High-quality bonds may be more stable in terms of regular income but returns are typically more conservative as compared to the stock market.

Can bond income investing protect you from high inflation?

For example, the July 2022 issuance of Singapore Saving Bonds (SSB) forecasted earnings for the first year to be 1.69% p.a. And 2.71% p.a. if held till maturity for 10 years.

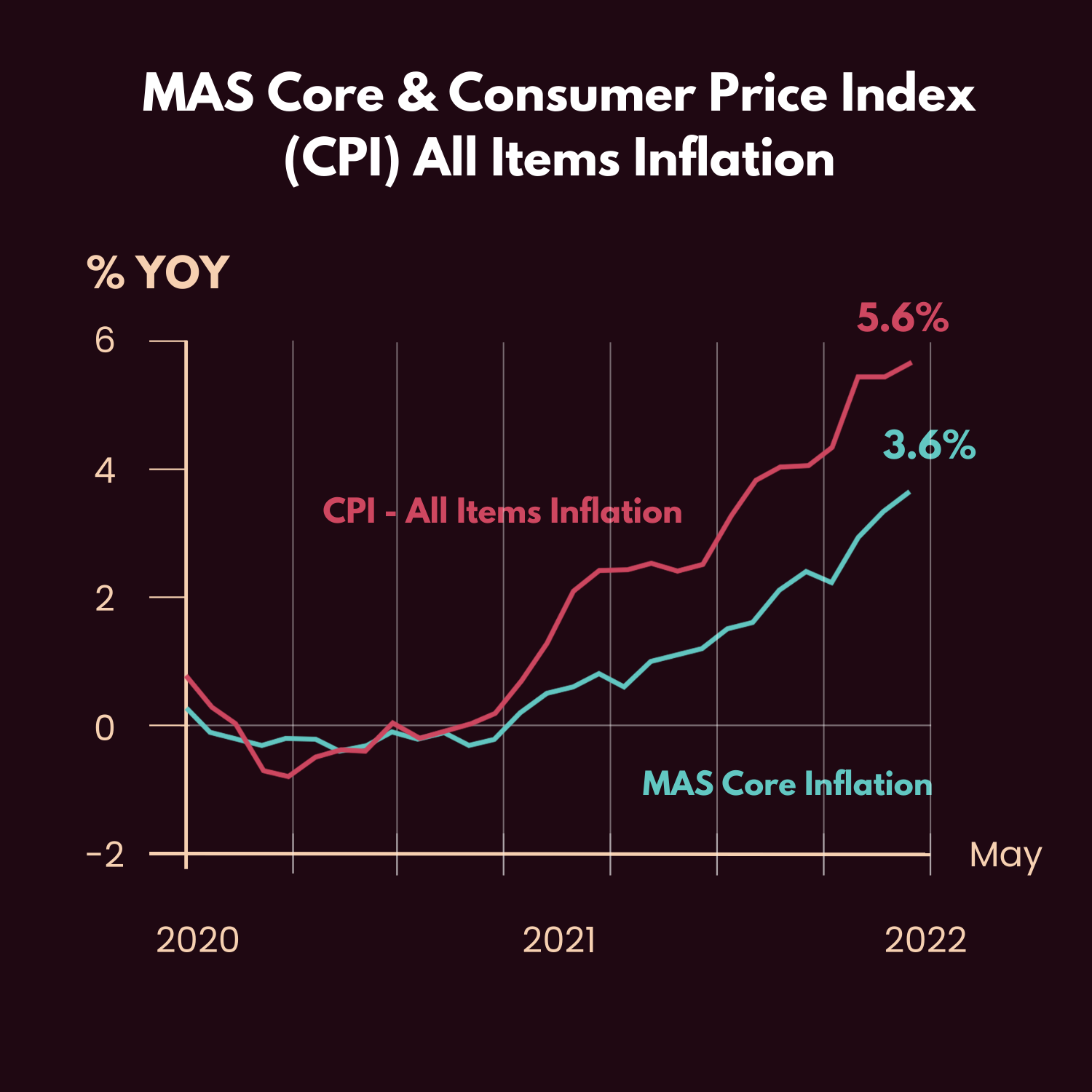

However, in May 2022, the MAS Core Inflation increased to 3.6%. The Monetary Authority of Singapore (MAS) expects the core inflation rate for 2022 to be between 3.0%-4.0% as of July 2022.

Data source: Singapore Department of Statistics

Based on the year 2022 alone, 1.69% p.a. from SSB is much lower than the forecasted inflation rate of 3.0%.

We can see here that although bonds have relatively lower risks, the potential returns are conservative as well. Hence, you might not be able to fully protect your purchasing power through bond income investing alone.

Is your capital really preserved?

Following the pandemic in 2020, interest rates had been slashed drastically around the world in order to support the economy. Since then, the economy had picked up the pace, which has led to high inflation.

Central banks around the world are seen to be increasing interest rates in order to curb inflationary prices to continue. For example, in June 2022, the Federal Reserve hiked its interest rate by 0.75% which is the steepest increase since 1994.

Back home in Singapore, base rates such as the Singapore Overnight Rate Average (SORA) and the Singapore Interbank Offered Rate (SIBOR) are also on an upward trend since 2020.

For context, SORA and SIBOR are benchmark rates that Singapore banks use to determine the final interest rates for borrowing and lending money.

You might be wondering, how does this apply to your retirement funds?

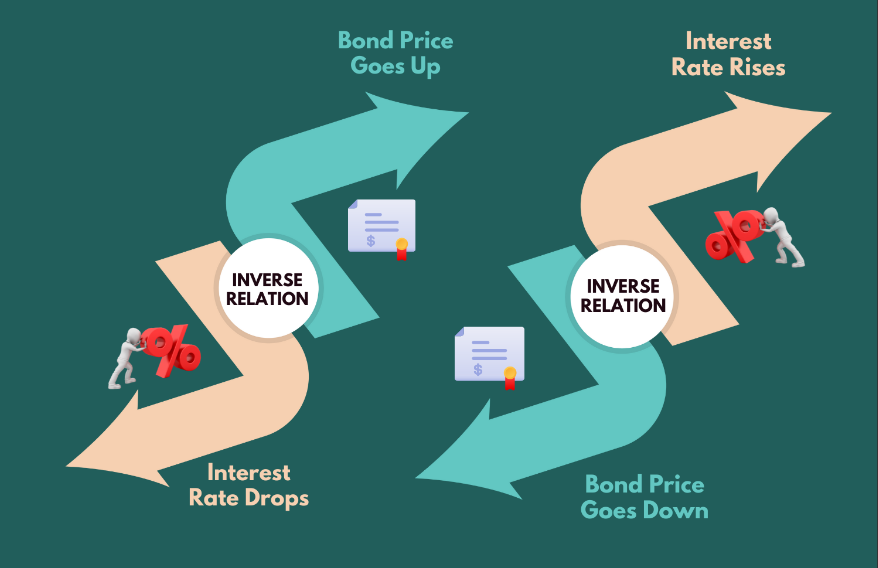

Though high-quality bonds may be resilient in volatile markets, bond prices drop in a high-interest rate environment.

In a high-interest rate environment, new bonds would be issued with higher interest rates and thus would be more attractive to investors than existing bonds. Investors will then flock to the new bonds and subsequently, prices of existing bonds would fall with the reduced demand.

If you sell your existing bonds prematurely when prices go down, you might be making a loss.

If you opt to hold up until maturity despite knowing there are other attractive bonds available, your purchasing power will still be eroded if the returns are not higher than the rate of inflation.

The price drop in bonds will also affect you if you are invested in a basket of bonds. For example, Exchange Traded Funds (ETFs) or unit trusts comprising bonds.

These ETFs and unit trusts enable you to invest in a basket of bonds and your investment returns will be dependent on the funds’ performance rather than individual bonds’ interest rates. This means that your investment returns will be affected in the short term by the short-term volatility of these funds.

So if your investment portfolio consists of a large proportion these ETFs or unit trusts, you may need to analyse your portfolio to see if it can really help you retire on time with the ideal amount retirement funds you need.

Additionally, you can also consider:

- Which market segments will thrive in a high-interest rate environment?

- How can you stay diversified in both the short and long term?

Are Real Estate Investment Trusts (REITs) reliable to provide stable passive income?

Investing in REITs is an excellent avenue to have a slice of the real estate investment pie without having to physically purchase the property. And you are able to invest beyond residential properties.

REITs are generally considered to be relatively lower-risk investment assets compared to regular stocks due to the nature of predictable recurring rental income from term leases. There are many types of REITs, such as commercial, retail, and residential REITs.

However, there are instances where you may get lower-than-expected income payments from these financial assets.

For example, the recent pandemic hammered retail and hospitality REITs’ revenues. Some REITs were seen to cut their dividend payments as pre-emptive measures to survive the pandemic.

During that period, SPH REIT (a retail REIT) slashed its dividend payment by almost 80%. Another retail REIT, Frasers Centrepoint Trust, reduced its dividend payment by almost 50%.

With social distancing and remote working going in full force in 2020 and 2021, many people stayed at home and opted for contactless solutions for their needs — which made badly affected retail properties.

Although the pandemic is a rare crisis, it brings home a very valuable lesson to investors — the importance of diversification. It is best not to concentrate your investments on only one or a few asset classes no matter how safe they may seem.

On the other hand, industrial and data centre REITs proved to be resilient during the pandemic.

However, they are still susceptible to certain risks:

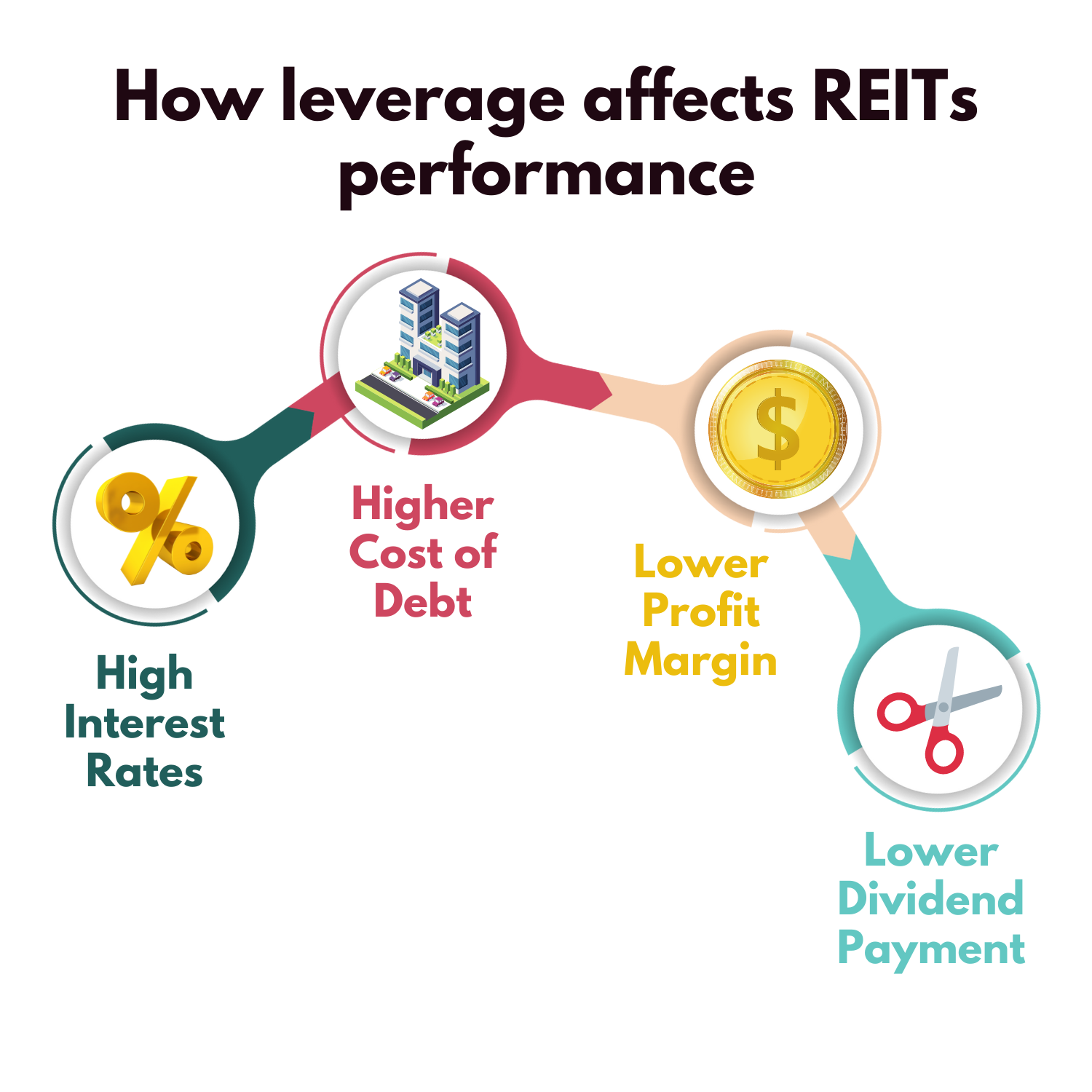

In property investing, leverage is a huge influence on REITs.

And what influences debt the most? You’ve guessed it – interest rates.

The current climbing interest rates may result in higher costs of debt for REITs.

This can result in lower profit margins.

And consequently, this may lead to a reduction in dividends for investors, unless the REITs you are invested in adopt inflation-adjusted term leases. But this is not always the case.

If REITs form a large part of your portfolio, you are actually concentrating your investment in the property market alone.

You may never know if another crisis may hit or if the high-interest rate environment may prolong.

That’s why, it is better to be well-diversified across asset classes, industries and geographies.

Is gold a good universal risk-hedging asset?

Gold can potentially be a good wealth preservation asset during financial crises.

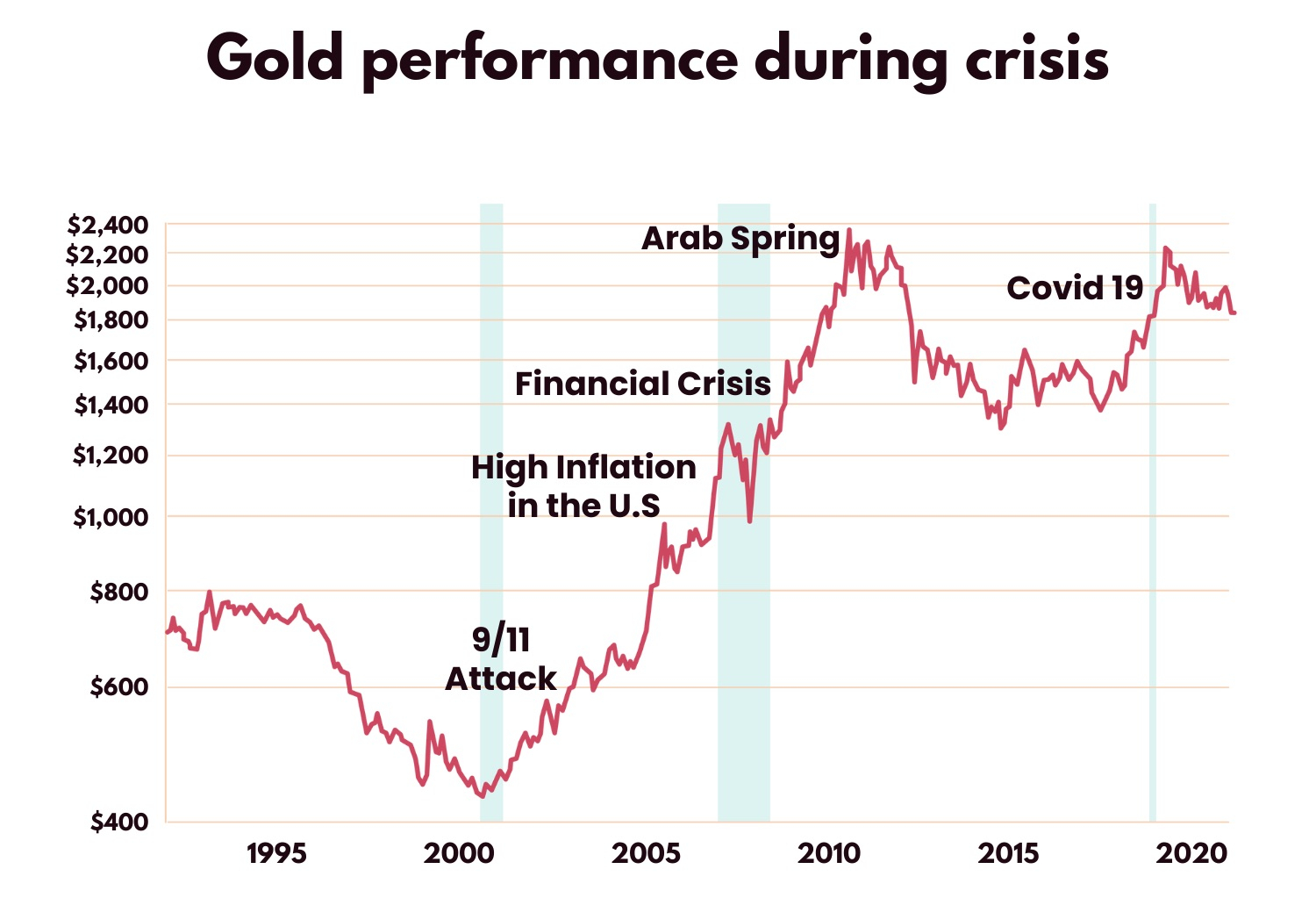

Historically, gold has proven to be a good asset to hedge against market uncertainties such as financial crises. The graph below shows how gold prices fared during turbulent times:

Source: Finviz.com

And because of this, gold is generally seen as a useful and stable asset to invest in. It has the potential to preserve your wealth in uncertain economic conditions.

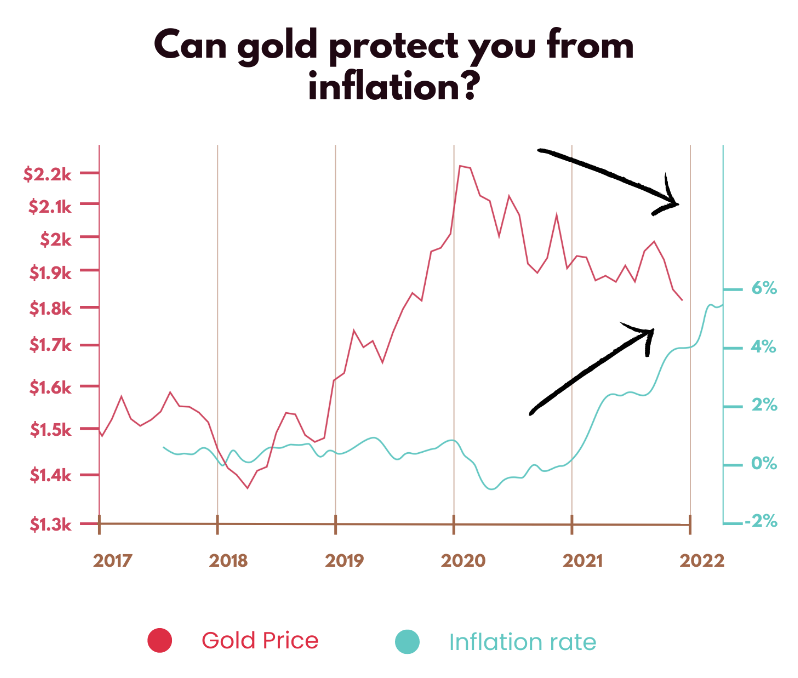

On the other hand, how useful is gold in protecting your wealth from inflation?

A study called The Golden Dilemma found that there was little evidence that gold has been an effective tool in hedging against unexpected inflation, be it for the short term or the long term.

Source: Finviz.com, Singapore Department of Statistics

Based on the graph above, you can see that gold prices do not necessarily move in tandem with the inflation rate. As highlighted, gold prices fared well in 2020 (during the pandemic) and over time you can see a decreasing trend up until mid-2022.

On the other hand, the inflation rate is climbing fast.

Hence, although gold might be a resilient tool during crises, it may not be useful in protecting your wealth against inflation.

So it all boils down to what your purpose is if you invest in gold.

Use the right strategy to protect your wealth effectively in the current volatile market

The prevailing market conditions – such as high-interest rates and high inflation – can heavily influence each and every asset, even if these assets are considered low-risk instruments.

So if you don’t manage your risk exposure to the downsides of each asset, you might be losing money instead of growing your wealth.

Would you have enough money in time for retirement and grow multigenerational wealth?

These changes in the market can happen during different market cycles or even all at once. Spotting the changes in the financial markets and their developments is not easy and can be time-consuming.

Hence, it is recommended to get professional help to manage and advise your investment decisions.

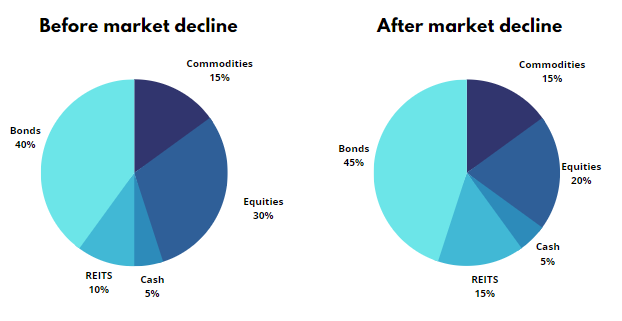

Below is an example of how I helped one of my clients to adjust her investment portfolios during a volatile market. This is because during a market downturn, she was not comfortable with her investment position.

After discussing it with me, she decided to take on a temporary shift to her asset allocation as her risk tolerance has lowered in such circumstances.

For illustration purposes only.

You can still be conservative in investments potentially without losing money due to inflation and market volatility. There are many other assets that have lower potential risks which can form part of your recession-resilient portfolio.

I have helped many of my mass affluent clients manage their retirement portfolios so their investments remain resilient in volatile and uncertain market conditions.

With my 8 years of experience working with more than 100 mass affluent families to potentially retire 10-15 years earlier, I will be able to help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.