How to Multiply Your Net Worth and Preserve Intergenerational Wealth?

Wealth preservation, Property investment, Estate planning, Legacy planning, Intergenerational wealth, Multiply Net Worth • 2025-11-08

In this volatile economy, how can you still increase your net worth and preserve intergenerational wealth?

Some of you might own a few assets such as properties and businesses, and intend to pass them on to your children and loved ones.

But life is unpredictable.

Without the right financial structures in place, even the most well-intentioned plans may not go as expected.

Wealth can also be eroded by inflation, market volatility, liquidity challenges and business liabilities over time.

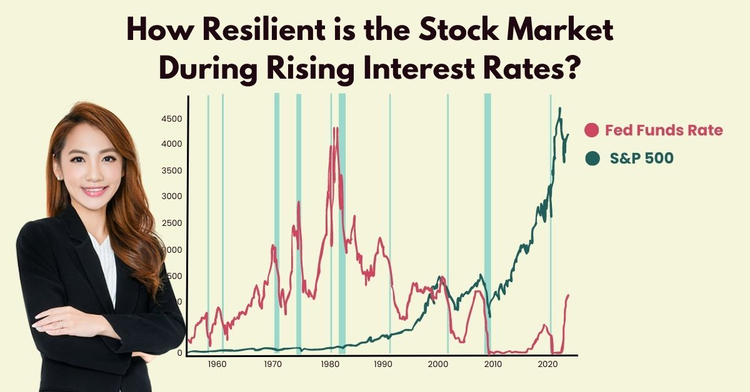

Fixed deposit interest rates and T-bills’ yield have also been falling (6-month T-bills’ cut-off yield fell to 1.38% in September).

The Fed also recently announced that the US central bank would cut its key interest rate by 0.25 percentage points.

How can you preserve your wealth by growing your reserve and put in the right financial structures to secure a peace of mind for a comfortable retirement and lasting legacy?

This is a strategic framework I often explore with clients who wish to strengthen their overall financial resilience and legacy planning:

✔️ Strengthen your financial reserves and create meaningful long-term value

✔️ Pursue consistent, risk-managed growth while safeguarding your capital

✔️ Ensure your wealth structures align seamlessly with both personal and business goals

✔️ Balance your estate with sufficient liquidity to ease future transitions and reduce over-reliance on physical assets

✔️ Build financial buffers that protect your loved ones and enhance family security

✔️ Promote continuity of wealth and values across generations

✔️ Maintain flexibility so your strategies can evolve alongside your life and business needs

Enjoy retirement on your own terms, while planning ahead intentionally.

As a Chartered Financial Consultant (ChFC®️) with over a decade of experience advising professionals, entrepreneurs, and business owners, I work closely with clients to design intelligent financial frameworks for long-term peace of mind and impact.

Also, as an Estate Succession Practitioner, I can also work with you on your estate equalisation – so as to ensure that your wealth distribution is well taken care of.

As the value of physical assets like properties may change over time, it could unintentionally lead to unequal estate distribution, which could lead to family conflicts.

True legacy isn’t just about wealth transfer, it’s about peace of mind for your loved ones.

If you are keen to find out more, reach out to me here.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.