Is dividend investing safe during high interest rate + inflation?

Passive income, Retirement planning, Investment, income investing • 2022-05-19

Over the years, when I helped my clients with their wealth preservation portfolio, I realised one common mistake they make — overestimating the potential dividend income they are going to get over their retirement years.

Many people don’t realise that even when investing in blue-chip companies or high-grade bonds, the changes in the economic environment and market can affect their potential investment returns.

That is why it’s important to ask, in this current high-interest rate and high inflation environment, is your investment approach still safe?

Can you still get your intended retirement income, and sufficient cash flow for your daily expenses?

Any form of investing requires a strategy especially if you are planning to preserve your wealth for the long run.

Simply buying a single fund or two and waiting for it to give you passive income can be dangerous — you could run the risk of not getting any returns at all during some periods!

Read on to find out why.

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Will you really get consistent dividend payouts from dividend investing?

“Put your money in dividend-paying funds” — have you heard of this before?

Often, dividend income is hyped for the steady passive income it potentially gives.

But in reality, dividend payouts are never guaranteed. The amount and frequency are always at the discretion of the companies.

So, why are investors shocked whenever there is a dividend cut or zero dividend payouts?

How do a high-interest rate and high inflation environment affect dividend payments?

There are two factors that are affected by such economic conditions:

- Besides equities, companies generally raise capital to run their businesses through debts. Hence, in a high-interest rate environment, companies would need to pay more in borrowing costs.

- In the event of rising prices due to inflation, this increases businesses’ overall costs.

These two situations will eventually lower their profit margin and consequently jeopardise their dividend payouts.

Can you imagine how would your dividend income be affected in a recession on top of high-interest rates and a high inflation environment?

If you are worried about your dividend income portfolio, feel free to reach out for a free portfolio audit.

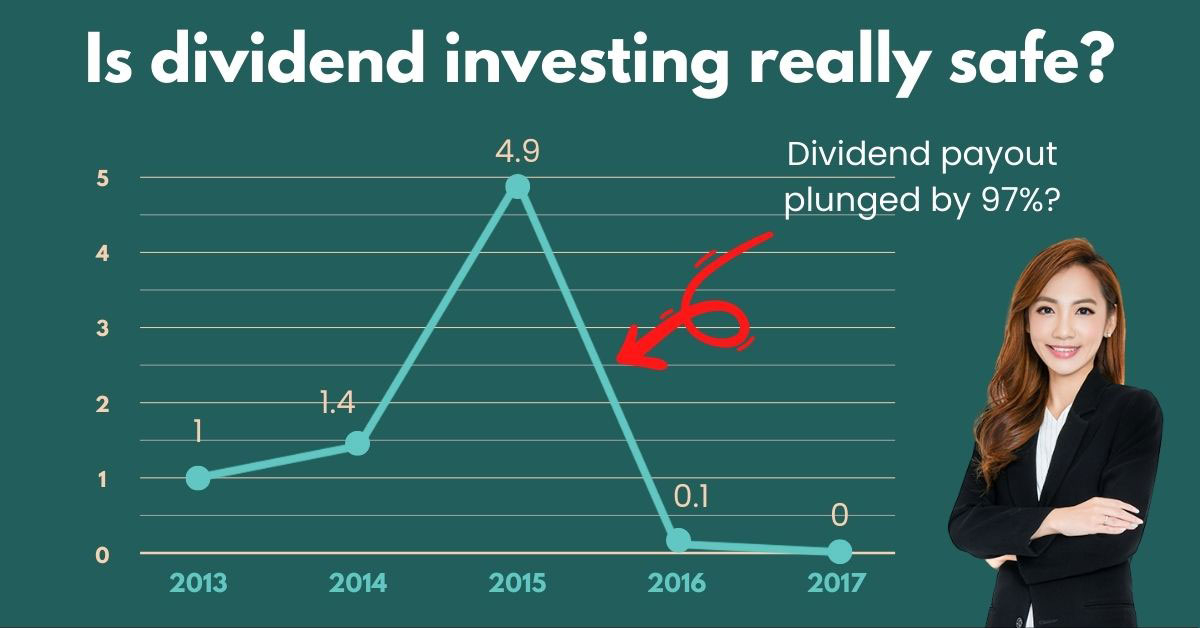

Why historical track record does not guarantee future payouts

Naturally, most of us would invest in assets with a solid track record of dividend payments. But it is important to note that the historical track record of consistent dividend payments does not guarantee future payments.

There is a possibility of dividend cuts or zero payouts.

Companies will put this discretion to their advantage, especially when faced with challenges when they need to preserve capital and liquidity.

Are you investing in another Hyflux?

Hyflux was a water-treatment specialist company based in Singapore. Here, where water will always be in high demand, Hyflux was once Singapore’s darling in the water sector.

As the company grew, Hyflux ventured into the power industry through the biggest seawater reverse osmosis desalination plant in Asia, Tuaspring Desalination Project.

The construction of the said plant was completed in 2013.

As the story unfolded, Hyflux found itself struggling to meet financial commitments.

Although some people were skeptical, many remained faithful to the successful company.

Oddly enough, the company appeared to be committed to paying out dividends despite having negative free cash flow for the next couple of years.

Negative free cash flow means that after paying for all capital expenditure, the company has negative cash flow.

Source: Hyfux’s Annual Reports.

At that time, many people could have been thinking: “Eh, but they are still paying out dividends! So should be okay one...?”

However, Hyflux was unable to solve its financial problems, and despite many restructuring efforts, the company wound up in 2021.

Source: Hyfux’s Annual Reports

Most of the time, people tend to assume that getting regular dividends is a financial indicator that the company is doing well.

In the case of Hyflux, since the company closed, all investors naturally stopped receiving dividends – but what was worse was that all their capital was also inevitably wiped out.

This case study just goes to show that it is not a good idea to just rely on regular dividend payouts to determine the financial health of a company. And although Hyflux’s downfall was not driven by high inflation and high-interest rates, you can see the potential impact of low profit margins on your investments.

For someone who is retiring soon, losing all of your capital can be very painful – how much time can you afford to grow your wealth back?

Securing your retirement income requires a holistic retirement investment plan that is recession-resilient through strategic diversification and solid asset allocation.

That said, you might wonder... what about bonds?

Bonds’ coupon payments should be regular, right?

But there are areas you might have overlooked.

Why investing in higher grade bonds may not protect your invested money completely

Higher grade bonds are solid investment assets to provide regular returns and are of relatively lower risk, as they are generally less volatile compared to stocks.

On top of that, because they are seen as of lower risk, investors will usually use these bonds as tools to manage their investment risks.

And with lower risk, the returns are usually more conservative as well.

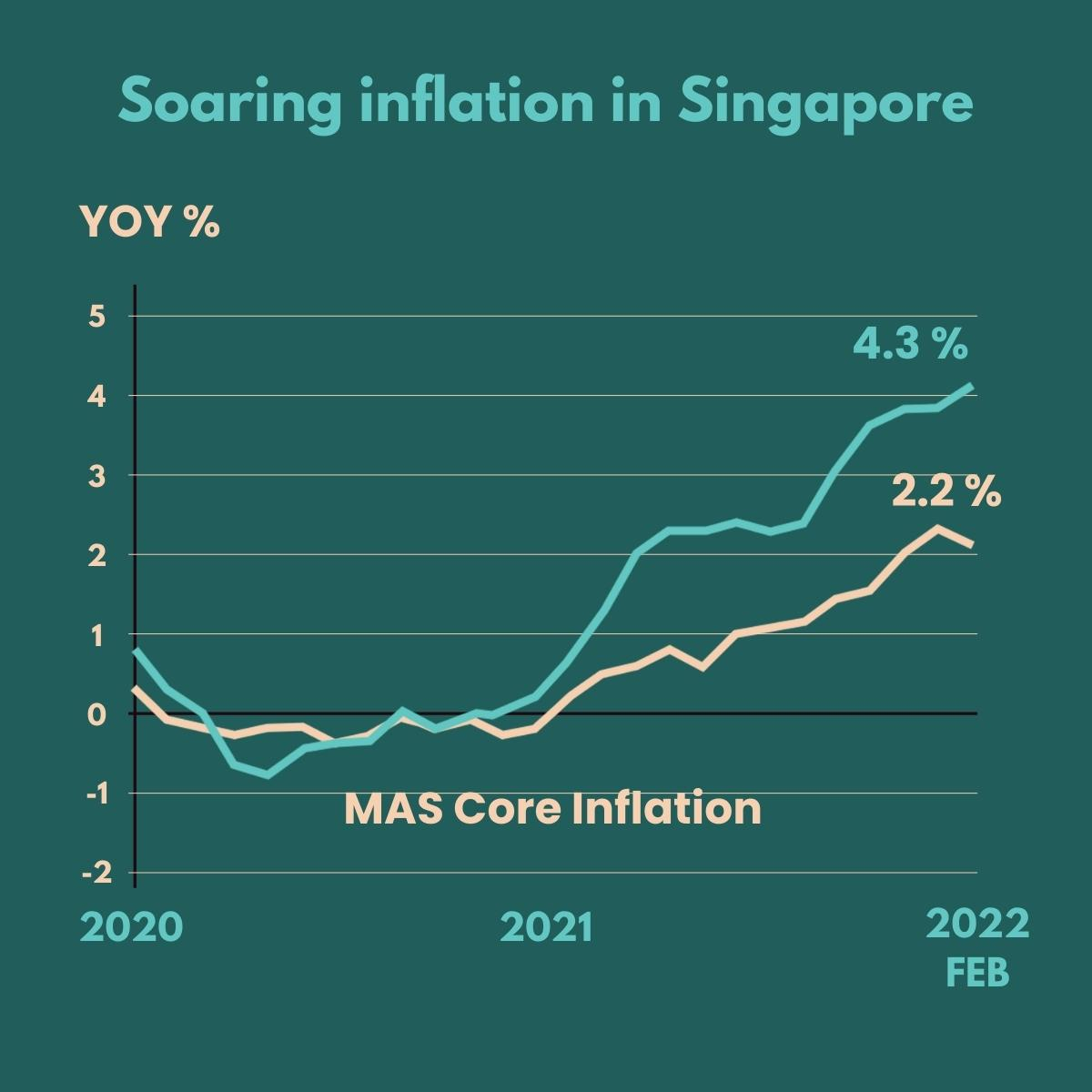

However, what may cause the returns to be worthless to your retirement income is the effect of inflation.

For example, you may have invested in the 1 March 2022 issued Singapore Savings Bonds which reflected the average p.a. return of 1.79% at the end of 10 years.

With inflation at an all-time high of around 4% in the first quarter of 2022, if you are investing solely in bonds that bring about an average of 2% p.a., will it help you beat inflation?

As the cost of living rises, your returns from the bonds may not be enough to cover your retirement expenses.

Often, we need to first set a financial goal (the amount you need for retirement) before working backwards after factoring in inflation to determine how much you need to invest to reach that goal.

From here, you are able to gauge what kind of instruments can potentially meet your goals.

However, the inflation rates today are climbing up a steep ladder, contributed by many factors such as pent-up consumer demand after the pandemic, wars, trade tensions and many more.

Source: Monetary Authority of Singapore

So, one might question — is it still a reliable method to work backwards from projected inflation rates in 10-20 years’ time?

The economy and financial markets have proven to be more and more unpredictable thus this calculation method or strategy might not be as effective in the future.

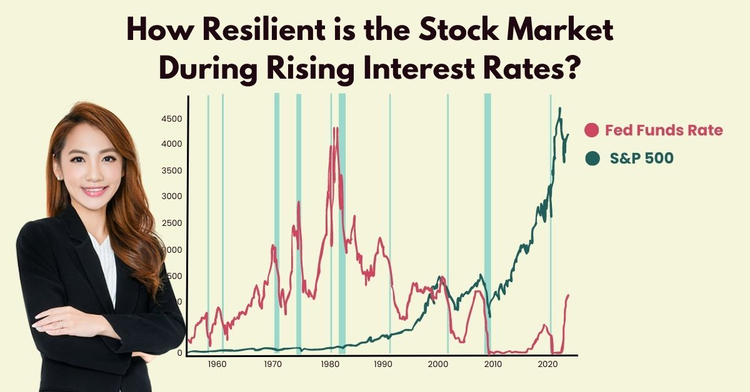

Additionally, besides not being able to beat inflation’s effects, it is also important to understand the dynamic of bonds in a high-interest rate environment.

Do you know that bond prices will drop when interest rates rise?

The Fed is increasing rates every once in a while (just like now in May 2022) to curb the serious inflation.

As bonds’ returns are generally more conservative as compared to stocks or funds, in an increasing interest rate environment, investors tend to invest in other assets that can potentially provide better yields for their investments.

Thus, this will result in a drop in the value of bonds.

Factors like inflation and the movement of interest rates are simply beyond our control.

This is why it is important to take a more proactive approach to your investment strategy, so that we can manage our risks effectively while ensuring that our investment returns are on track to meet our retirement needs.

An experienced and licensed Financial Adviser Representative (FAR) would be able to help you strategise a holistic strategy to prepare you for future challenges that might affect your investments.

This is what I have helped my clients to do while helping them to generate multiple passive income streams for retirement using my investment framework.

And I can do this for you too →

Can hunting for high yields protect you from inflation?

Is high yield the best indicator of an asset’s performance?

Naturally, most investors want to capture the assets with the highest yields to beat inflation and grow our wealth.

We want to be able to make the most out of our money.

While we generally refer to high yields as a successful indicator, it can also be deceiving.

Also, an unusually high yield dividend may actually be a red flag.

It begs the question – will the company or fund be able to continue distributing the high dividend consistently in future?

This metric alone also doesn’t show you the bigger picture. You need to watch out for the underlying basis of the yield before investing.

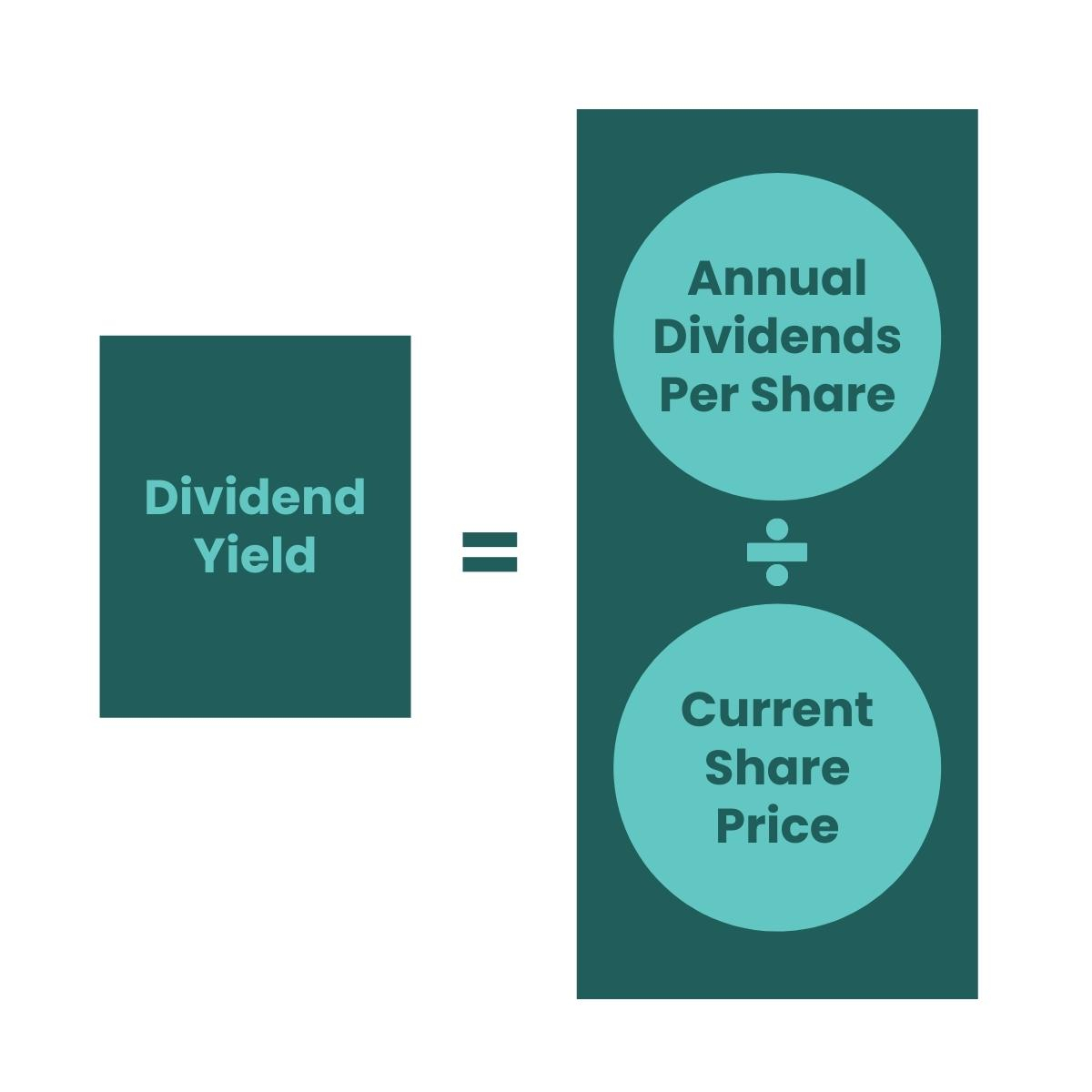

For example, dividend yield and share price move in opposite directions. If the share price falls due to financial trouble or a market downturn, the dividend yield may actually rise. This is because dividend yields are calculated based on the share price.

So, if originally the price per share is $100, and the dividend payout is $5, the dividend yield is 5%. If the price was down to $80, the dividend yield of $5 would be 6.25%.

And if the price goes down due to fundamental reasons such as unsustainable management, reckless financial decisions or others, investors will usually take flight from such assets — which would eventually bring down the share price even more.

But if as an investor you are still being paid the same amount in dividends, the dividend yield would actually be a higher percentage (so on the surface, some people might wrongly perceive that the company is doing well).

Similarly, for bonds, high yield bonds are actually reflective of the credit risk associated with investing in the company.

In bonds, their credit risks can be determined by their credit rating. It reflects the ability of a corporation or institution to pay their bonds’ coupon payments.

The higher the credit risk of an issuer, the higher the coupon rate of the bonds, meaning the higher your potential returns might be as a lender or investor.

Let me share with you a story where investors had to learn a very painful lesson in the year 2020.

A local bank in India, known as Yes Bank, issued a high yield perpetual bond of 6% a year (which means investors can get 6% p.a. returns forever, or for as long as they hold on to the bond).

Sounds like a good deal? Many investors thought so too and took a bite of this offer.

Little did they know, the perpetual bond was categorised as an Additional Tier-1 bond.

And within the principal terms and conditions of the bond, in such a category, the bank has the right to liquidate the bond to support its capital as needed without owing anything to bondholders.

When it was marketed, this part of the terms and conditions was missed by investors. Hence, many people invested without fully understanding the inherent risk of the bond.

Yes Bank faced financial challenges which eventually required the national financial regulatory body to put the bank under a restructuring scheme to revive its finances.

Part of the efforts was to write off the Additional Tier-1 bonds. Hence, many investors lost their capital.

That is why such bonds bring relatively higher yields than other bonds. In this situation, you risk losing all of your capital together (don’t even talk about losing dividends!).

So before you invest in any high yield bonds, ask yourself, what is the asset’s real potential performance? What are the risks involved?

You can discuss with a professional the best strategies to minimise your risks especially when you invest in assets that are not quite familiar to you. FARs are able to recommend investment strategies that can help you keep risks at a minimum so your retirement income is protected.

So how do you build your wealth and achieve good passive income for retirement?

No investment approach is perfect.

This is why you need a comprehensive strategy to complement one approach with another.

In order for you to get a good and regular passive income through investing, you must not focus on only one type of asset class like a dividend fund or bond fund.

I have helped more than 100 mass affluent families be on track to retire 10-15 years earlier with my recession-resilient income investing strategy.

My approach is usually holistic – to help you not only potentially grow regular passive income but also grow wealth so you can potentially retire earlier and create multi-generational wealth for your family.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.