The Real Costs of Growing Old and Falling Sick

Long term care, insurance • 2024-04-10

No one wants to think about growing old. Or the suffering that could come with sickness in old age.

But it’s a reality that could happen to many of us.

Nowadays, Singaporeans are living longer.

And the risk of disability is higher in old age.

There can be many causes of such disability – stroke, spinal cord injuries, dementia, diabetes and other chronic conditions, or even critical illnesses such as cancer.

Seniors with these disabilities usually require help with daily living activities such as bathing, feeding, dressing, toileting, transferring and mobility (the ability to sit, stand and move independently).

Last year, the Ministry of Health (MOH) said that by 2030, around 100,000 seniors in Singapore will require such help – which is also known as long-term care.

Long-term care in Singapore can cost at least $2,000 a month, while the basic costs of staying in a nursing home would also range from $2,200 to $4,200 per month, depending on the level of care required, according to the Agency for Integrated Care (AIC).

3 in 10 Singaporeans with a severe disability (the inability to carry out three or more activities of daily living) could remain disabled for 10 years or more. The median duration of severe disability is 4 years.

How many of us can realistically afford such expenses in our old age? Especially in the long term?

If we don’t want to burden our family, what avenues can we tap into to help us financially?

Many of you might be familiar with CareShield Life – a national long-term care insurance scheme which provides basic financial protection against severe disability.

All Singapore citizens and PRs born in 1980 or later are universally covered under CareShield Life from Oct 1, 2020, or when they turn age 30, whichever is later.

If you were born before 1980 without severe disability, you can receive up to $3,000 from MOH to offset premiums over 10 years if you join CareShield Life before Dec 31, 2024.

But do you know how much coverage you need to ensure you are sufficiently insured for long-term care?

So that in case something unfortunate happens, you can focus on getting well and spending time with family instead of worrying about finances?

At TheFinLens, over the last 10 years, we have worked with hundreds of families to ensure they are sufficiently insured, so that they can optimise their wealth protection, preservation and accumulation, and retire comfortably without worrying about potential medical bills, long-term care costs or retirement expenses.

If you need help with enrolling into CareShield Life and assessing the coverage you need, just drop me a WhatsApp at 96938745 or through this link.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

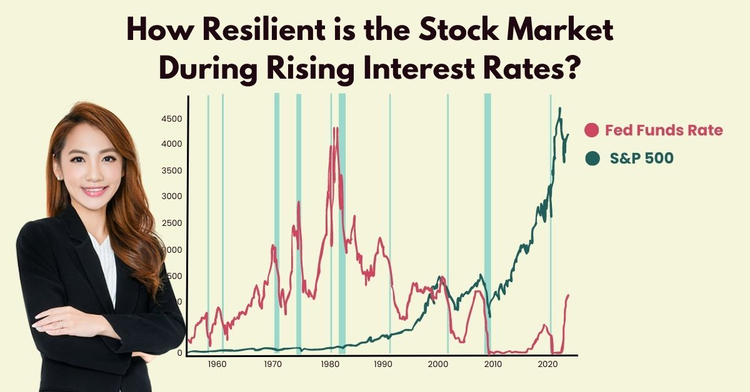

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.