These Singaporeans did not do legacy planning right and their families had to pay the price

Legacy planning, Estate planning, Retirement planning • 2022-08-24

Many of you might have purchased properties as assets to be passed down to your children and loved ones.

Some of you might have done so via a trust, to be passed on to your children (who may still be minors) in future.

However, the Ministry of Finance announced earlier this year that from 9 May 2022, any transfer of residential property into a living trust will now be subject to an additional buyer’s stamp duty (ABSD) of 35 per cent (though you can get ABSD remission if you meet certain criteria).

This means more cost to you if you intend to pass down your wealth this way.

What would be the viable options for you if you want to leave a legacy for your loved ones?

This is where holistic legacy planning comes into play.

Families of different backgrounds use legacy planning to preserve their wealth and protect their families in the long run.

As long as you own assets, be it properties, investments or even cash and you want to pass them on to your loved ones, good legacy planning can make a difference in how your wealth is being distributed when you are no longer able to control your wealth (whether due to death or loss of mental capacity).

And a wrong move can cause your loved ones to bear the expensive consequences.

At The Fin Lens, I help my mass affluent clients invest and build multigenerational wealth so they can retire earlier and leave a legacy for their children. Start mapping your 6-figure retirement plan now.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Unnecessary expensive burdens will be borne by your family without good legacy planning

I have seen friends and clients’ families suffer from the consequences of the lack of legacy planning. Often, people feel that it’s not necessary, or they have confidence that their families would be able to settle it harmoniously when they pass on.

But life is not a fairytale, and when money is involved, it can widen the cracks in any family.

Here are some common scenarios I have observed from the people around me (names have been changed for privacy reasons).

1. You are not sure if your children will squander away your wealth after you pass on

Nick and Jess had two children. Lucas and Lily. While Lily was a responsible person, Lucas was more likely to spend his money at Genting than save it for his future. The couple both passed away while their children were both young adults.

They failed to set up proper legacy planning for their children. According to the law, both children received an equal distribution of assets.

As the couple left their assets to heirs outside a trust, these assets are often liquidated and distributed in a lump sum.

Years passed, Lucas wasted his inheritance on luxuries and entertainment while Lily utilised it responsibly.

Over time, Lucas pressured Lily to give some of her inheritance to him because the money was actually from their parents and he is still her brother.

This puts Lily in a very awkward position as she deserves her share of the inheritance but at the same time if she feels the responsibility to take care of her brother. Their relationship was significantly strained over this matter.

Nick and Jess could have implemented planning arrangements through wealth distribution methods via a trust. This can protect Lucas from his immaturity and also Lily from the stressful and awkward situation.

What is a trust and how does it work?

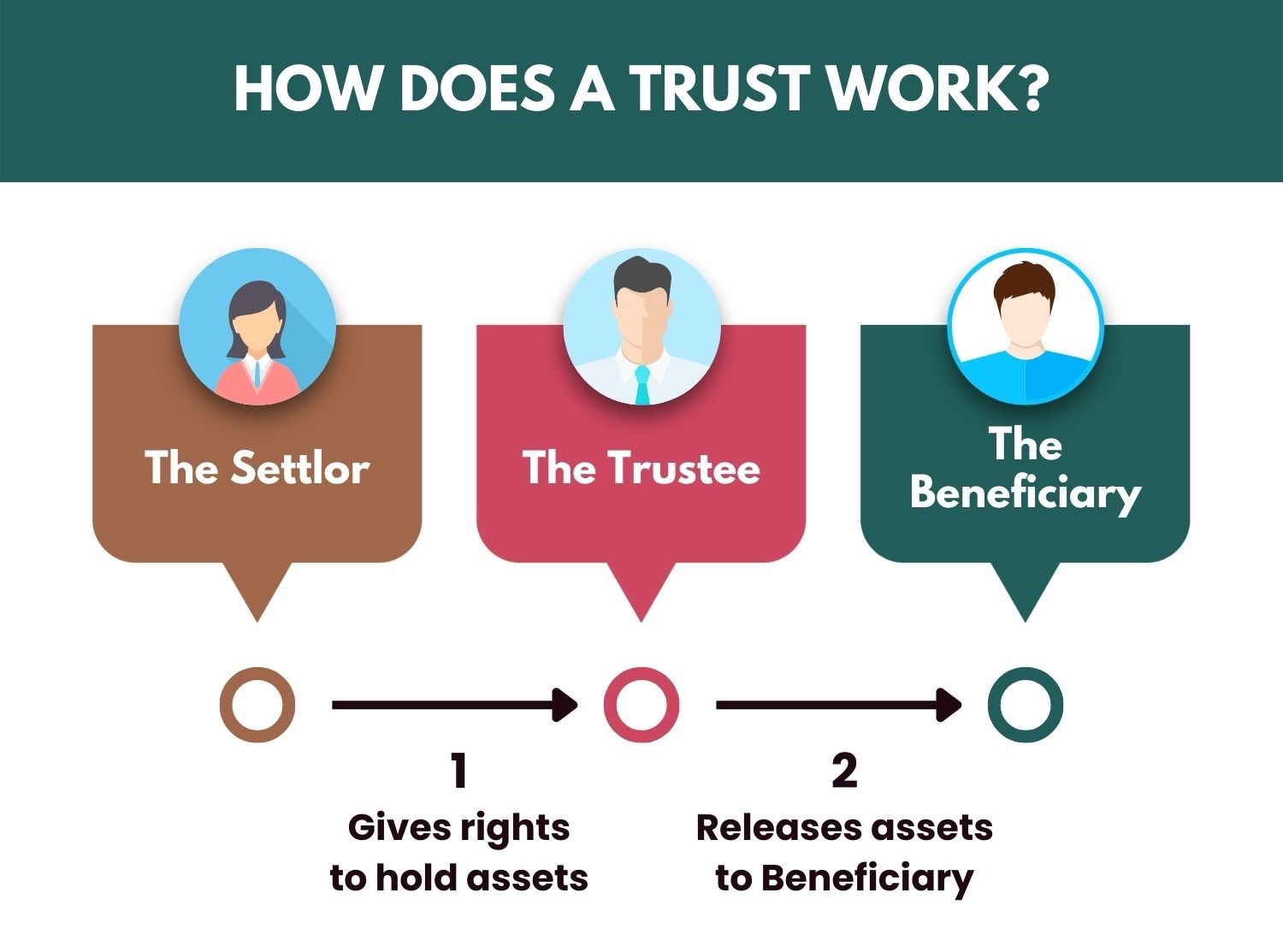

A trust is a legal entity that can hold your assets. It is a document that allows you (the Settlor) to place your assets and appoint a third party (the Trustee) to manage and administer them for the benefit of others (the Beneficiaries).

In said document, it spells out how you want your assets to be held. You will have the option of determining how much and when you would like the wealth to be distributed to the beneficiary.

There are many types of trust. To name a few – living trust, asset protection trust, testamentary trust and many more. Each has its own purpose depending on one’s financial situation and goals.

You would typically need to consult an estate planning attorney to set up a trust fund. Alternatively, you can reach out to financial planners who can help you get connected to the right channels.

How a trust benefits you:

- Prevent heirs from squandering money or falling victim to a financial scam. As the Trustee has the discretion to grant, deny or modify any request for the disbursement of assets (according to the trust documents), your wealth will be protected from any irresponsible financial decisions.

Due to the flexibility provided by trusts, your assets can be passed on to the beneficiaries at a later stage when they are legally adults or progressively when they attain any prescribed milestones such as marriage or when they have bought their first home.

Therefore, your assets are protected from being squandered. The payouts can last as long as possible and serve their purposes accordingly for your family.

- Protection from creditors. A trust can also protect the assets in the case where the beneficiaries run a business and he/she faces bankruptcy. Any assets under the trust will be protected from being liquidated, thus protecting your assets and your beneficiaries’ well-being as well.

2. What if someone whom you don’t intend to pass on your wealth to inherits your assets?

Here is another case that we can take heed from, too.

Fred (not his real name) was a dear friend of mine. As his close friend, I knew that his inheritance outcome was not the most ideal situation for him.

Fred and Katie were in the midst of finalising their divorce. As Fred and Katie’s relationship did not end on good terms, Fred had expressed his intentions to only pass on his wealth to his three children.

However, Fred did not provide a written will. Fred got into a car accident. Unfortunately, he did not survive the crash before finalising his divorce.

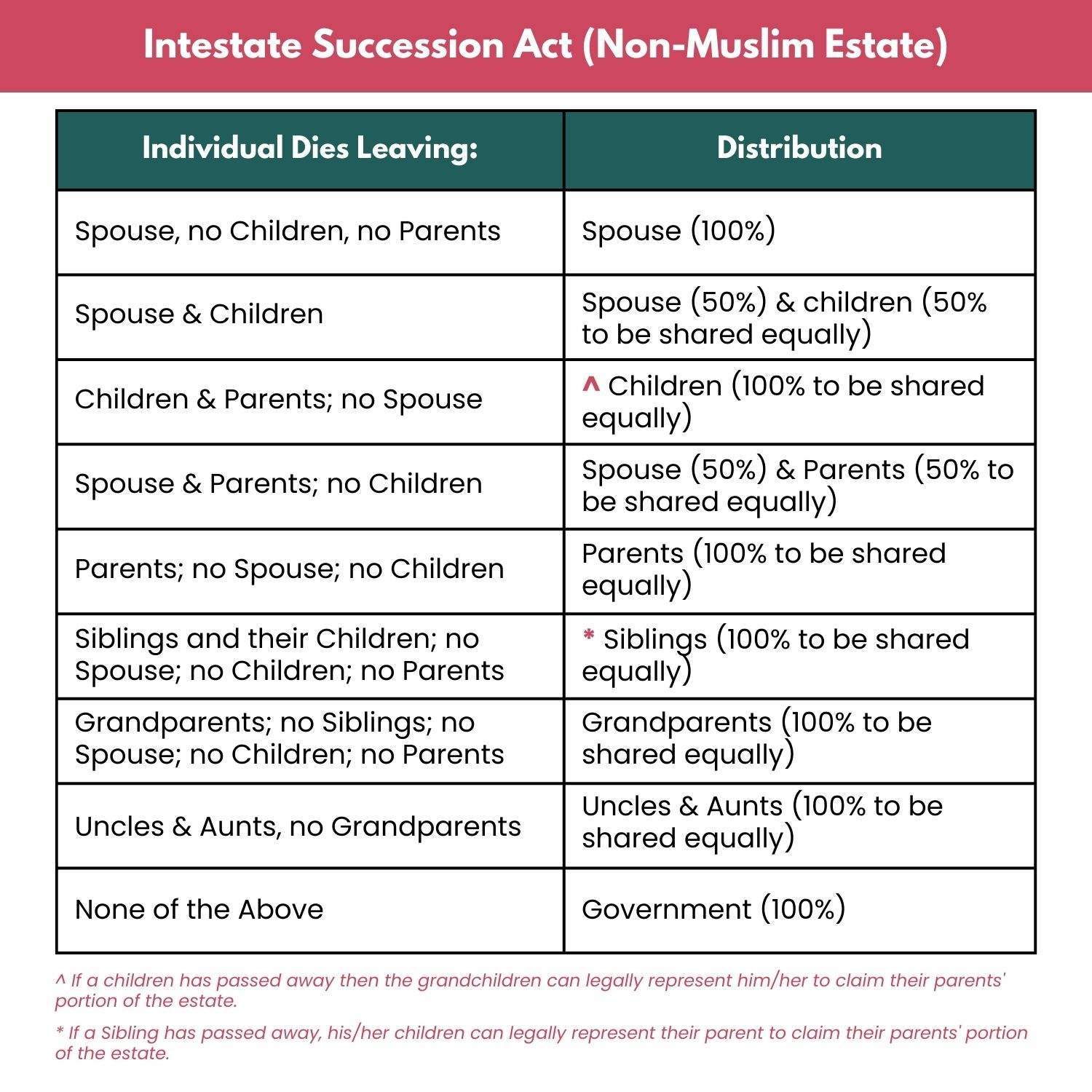

Without a will, according to the Intestate Succession Act 1967, when an individual dies leaving a spouse and children, the spouse will inherit 50% of his assets and their children will share the remaining 50% equally.

Source: Intestate Succession Act 1967 from Singapore Statues Online. This data is derived in September 2022 and the legislation is subject to changes.

Fred could have prepared a will so his wealth will be channelled to those to whom he wants to distribute his wealth – in this case, his children. Katie benefitted from this misfortune as she was entitled to half of her late husband’s net worth, which was not what Fred would have wanted.

What is a will and how does it work?

A will is another important document in estate planning. In terms of wealth distribution, a will is a more comprehensive document as it will cover all of your assets. However, it does not protect your assets as a trust does in terms of disbursement and control over the named assets.

In order to legally pass the assets, the document must go through probate. Probate is a process that administers the distribution of a deceased person's assets.

And if you die with or without a will, the legal transfer of assets must go through this process.

On top of that, a will details what will happen to your minor children, dependents with special needs and also the entitlement to your assets after you pass on. This also includes any executors and trustees in the event of your passing.

Without a trust, assets are typically liquidated and paid in a lump sum to the named heir (according to the will (if any) or law). Otherwise, assets will be distributed via the trust.

In a nutshell, a will is an important document that ensures your legacy is taken care of and it takes effect only upon your death.

How a will benefits you:

- In Fred and Katie’s case, a will is able to distribute wealth according to your wishes. Your assets will be distributed to those whom you want to pass to.

Hence, the will is able to minimise conflicts among family members.

- Besides that, since a will contains the appointment of guardians, executors and trust, it will be able to speed up the wealth distribution process and minimise any costs of appointing a third party to execute and administer the wealth distribution process.

- If you have already set up a trust, a trust only controls what they own, and sometimes we make the mistake of not maintaining and updating the assets in the trust.

A will is able to cover any assets that you missed to pass on to your loved ones.

If you want to ensure proper legacy distribution, feel free to reach out to me. As both a certified holistic retirement planner and a legacy planner, I will be able to help you plan your legacy distribution for you and your family.

3. What if someone you don’t trust has to make important decisions on your behalf?

Last but not least, this scenario may be ‘far-fetched’ but you must consider the possibility of losing your mental capacity in your lifetime.

You might feel that the chances of losing our mental capacity are low. But in reality, it could happen to the best of us, especially in old age.

This lesson was learnt from what had happened to a family member, Kevin (not his real name) and what his eldest son had to endure because of a lack of legacy planning.

Adam is currently taking care of his father, Kevin, who lost his mental capacity at the prime age of 65. Kevin was diagnosed with Alzheimer’s disease — which is fairly common for his age bracket.

Adam is experiencing a lot of difficulties because Kevin didn’t grant anyone the lasting power of attorney (LPA) to make decisions on his behalf. This includes legal decisions about finances, property, healthcare and even personal care.

This puts Adam in a difficult position as he had to apply to be appointed as his father’s deputy in court in order to act on his behalf. This process is expensive and time-consuming for Adam.

Meanwhile, the court had to appoint a professional deputy to make decisions on Kevin’s behalf, someone who does not know Kevin like Adam does.

Kevin could have granted the lasting power of attorney to Adam, someone he truly trusts to act on his behalf in any legal matter. This eases a lot of processes as Adam would be able to act and control Kevin’s wealth with his best interest at heart.

What is Lasting Power of Attorney (LPA)?

A lasting power of attorney (LPA) helps you appoint people you trust to act on your behalf should you lose the mental capacity to do so on your own.

The person who is given LPA is known as the Donee. The Donee becomes the one taking care of the Donor’s duties on his/her behalf. They are able to manage finances or make decisions relating to the Donor’s health and welfare.

How LPA benefits you:

- In the event that you lose your mental capacity, your spouse or children will not be automatically given the right to make legal decisions on your behalf.

This can limit their ability to care for you, especially for situations that require legal authorisation.

Granting an LPA will save your family members extensive legal processes and costs to be appointed as your deputy.

- If you are approaching old age, granting someone you trust an LPA would give you a peace of mind that your wealth and welfare will be managed with your best interest at heart if you ever lose your mental capacity.

Your step-by-step guide to wealth and legacy planning

You are probably thinking of preparing a trust or a will for the purpose of passing on your legacy. You might have already reached out to lawyers or financial consultants on this matter.

Legacy planning can be complicated.

It consists of many parties and elements and sometimes it can be confusing to some. It helps if you have an expert’s assistance each step of the way.

Here’s a simple guide on what you can do:

It is more beneficial if you have someone who can help you manage your finances, assets, as well as all these processes and documents holistically.

This is so that your finances, assets and legacy planning are overseen by someone who can have a macro and comprehensive understanding of your needs in totality.

This is exactly what I can do for you. I am an experienced professional in holistic retirement planning – and I can help you build wealth for retirement and also preserve it for your next generation. As a legacy planner as well, I will be able to help ensure that your wealth distribution is well taken care of.

With my 8 years of experience working with more than 100 mass affluent families to potentially retire earlier with their desired income and assurance, I will be able to help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

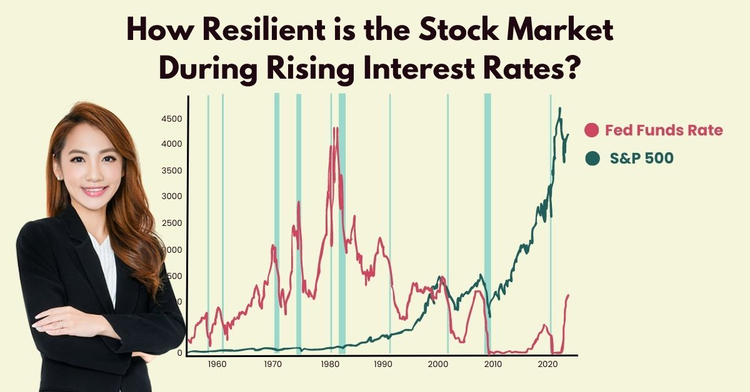

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.