You might outlive your money if you make these 3 retirement planning mistakes

Wealth preservation, Retirement planning, Passive income • 2022-08-10

What if I tell you that you are actually richer than you think?

Because this is usually the case whenever I plan a comprehensive retirement plan for my clients.

Some of you might think you need to work beyond retirement age because it is impossible to retire early in this day and age.

And you might wonder, “will you outlive your money?”

But in reality, many Singaporeans CAN afford to retire comfortably.

One of the keys to a sustainable retirement plan is to strategise your financial planning according to your life stages.

So, if you are retiring in 5 years or less, it is prime time to shift your financial strategy to focus on wealth preservation instead of wealth accumulation.

But even wealth preservation needs to be done with a strategy, so that you can ensure that you don’t outlive your money.

Here are some wealth preservation mistakes that can deplete your money faster than you think.

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

1. Too Many ‘Sleeping’ Assets in Your Portfolio

A client of mine — Simon — had put in a lot of effort to preserve his wealth by investing in physical assets, such as properties, gold and many other assets. Little did he know that too high allocation of these assets in his portfolio causes his portfolio to be not well optimised for wealth preservation.

Because of this, he was unable to retire earlier, despite accumulating so many assets.

This made him frustrated and worried.

His assets were mostly illiquid, and he did not know how to ensure that they generated consistent, sustainable passive income or dividends so he could retire comfortably.

So he figured he might need to work for a few extra years before he could finally retire.

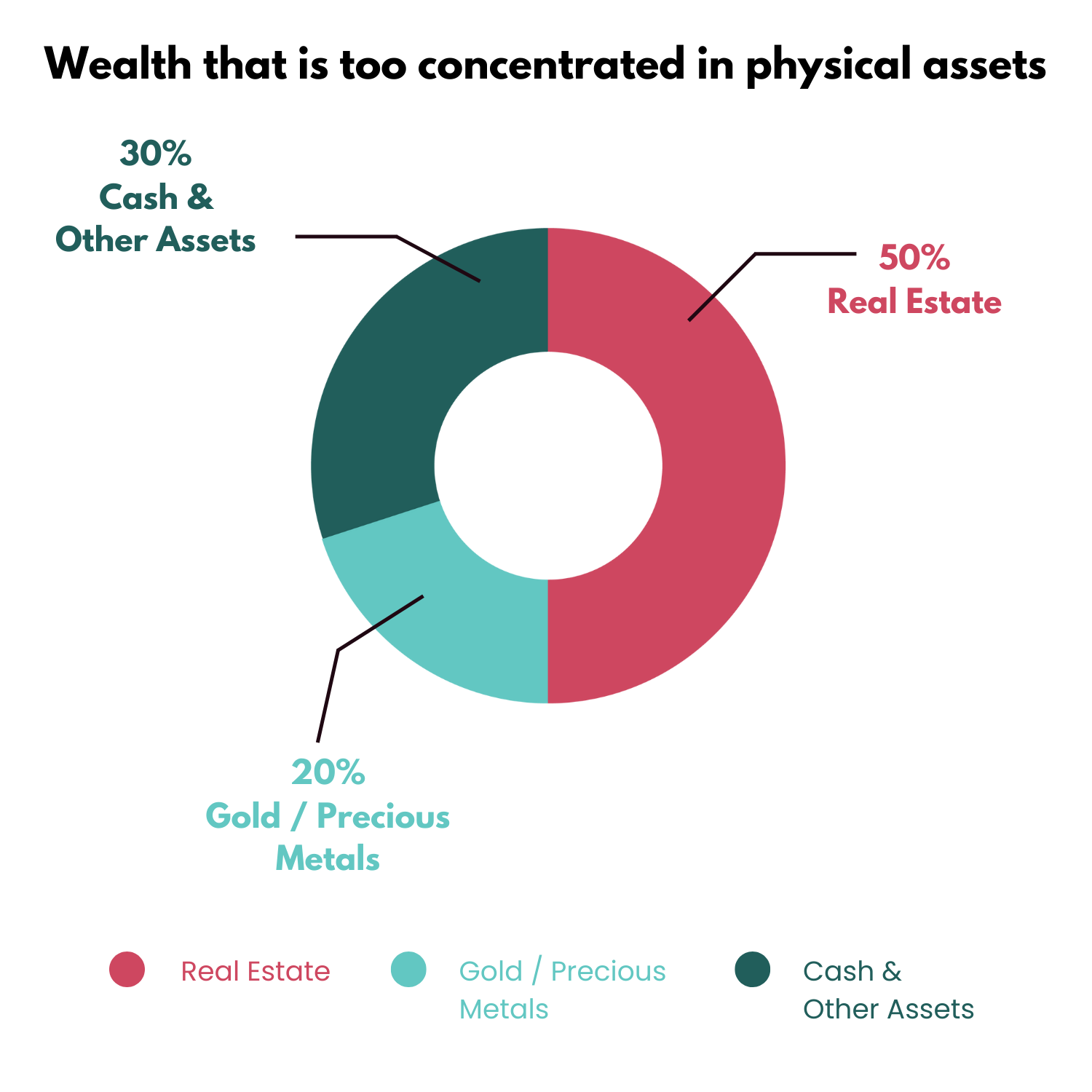

For illustration purposes only.

Above is what Simon’s initial wealth portfolio looks like. It turns out that 70% of his net worth consisted of such assets that were not optimised to give him the returns he was looking for.

Are the Returns from Holding Physical Assets Worthwhile?

For physical assets to maintain and appreciate in value, usually they require a certain extent of maintenance and effort.

For example, Singaporeans love to invest in property because it can potentially generate rental income. And ultimately, these assets can be transferred to their children when they pass.

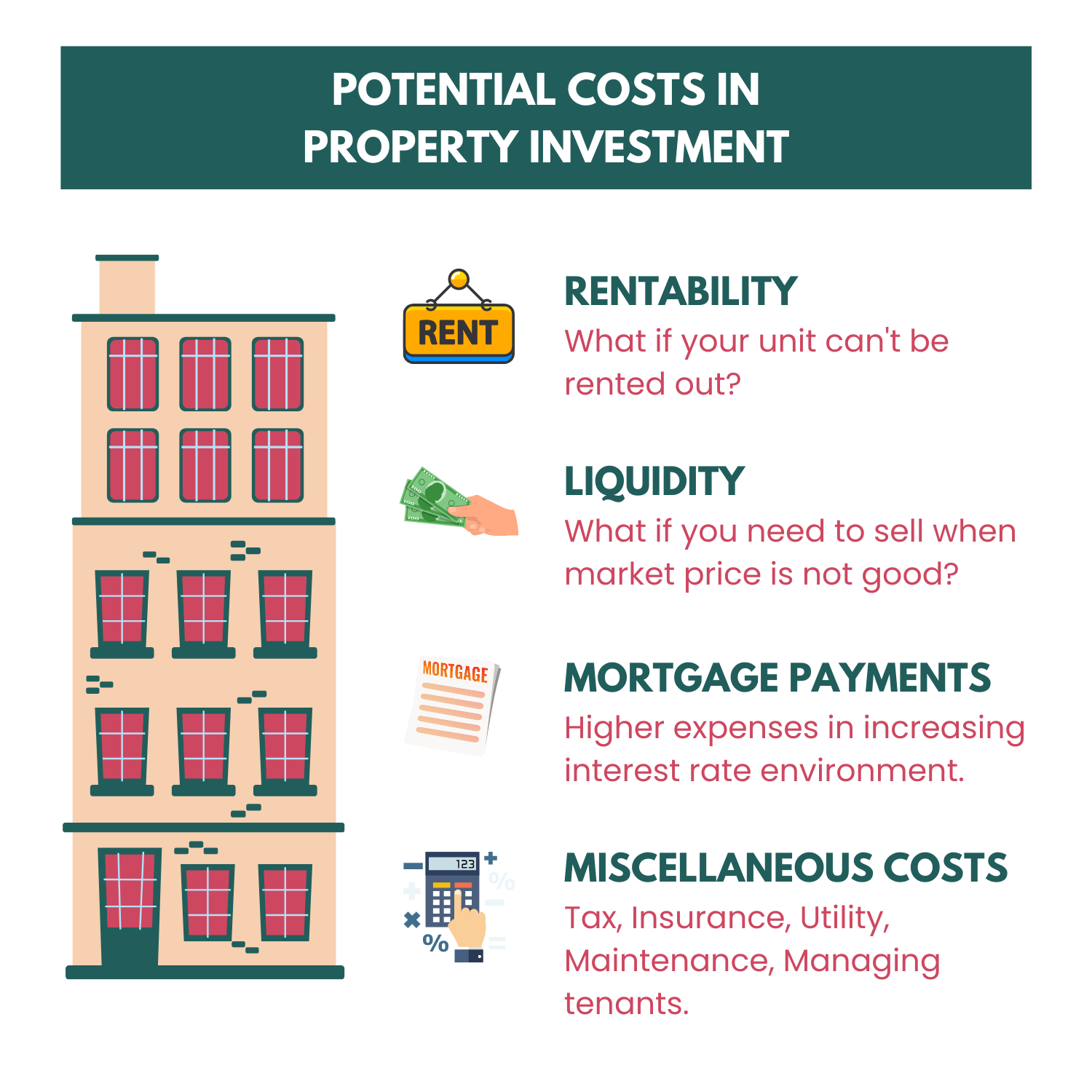

However, have you considered the costs of getting rental income?

For illustration purposes only.

I understand that the potential upside to property investment can be rewarding.

But have you ever wondered if there is any other way for you to get sustainable monthly passive income without needing to worry about all of the risks and costs?

Fortunately, there are many avenues that you can do to preserve your wealth besides physical assets.

All you need is a recession-resilient framework and retirement strategy that can give you potentially the most optimised returns. In a more cost-effective way.

So that you can retire comfortably and get to spend quality time with your loved ones during your golden years, without worrying about whether you might outlive your money or if you don’t have enough to pass on to your children.

If you are keen to find out more about how this works, feel free to reach out to me. I can provide a comprehensive financial assessment for your retirement needs.

2. Focusing on Leaving a Legacy for Your Kids, but Ending Up Burdening Them Instead

Going back to Simon’s story, he invested in many physical assets so he could leave a legacy for his children.

But he did not realise that because he focused too much on leaving a legacy, he neglected his own retirement income.

Little did he know that he might actually be jeopardising his children’s future instead by doing so.

Many Singaporeans might think, “Aiya, it’s okay, my kids will take care of me when I’m old and unable to work anymore.”

This is a common mindset many of us have.

And consequently (even though many of you want to put your children first), when you don’t have a sound retirement income in place, you are actually putting them in a very stressful position to have to juggle between taking care of your financial well-being as well as raising their own children too.

Some of us might also feel that we can just depend on our CPF LIFE payouts for retirement. Surely, if we live a modest lifestyle, the payouts should suffice, right?

But to be honest, modest can be really subjective and sometimes, the cost of your basic needs could be high if you include long-term care costs in the equation.

And it is tough for us to predict if we may need long-term care in future.

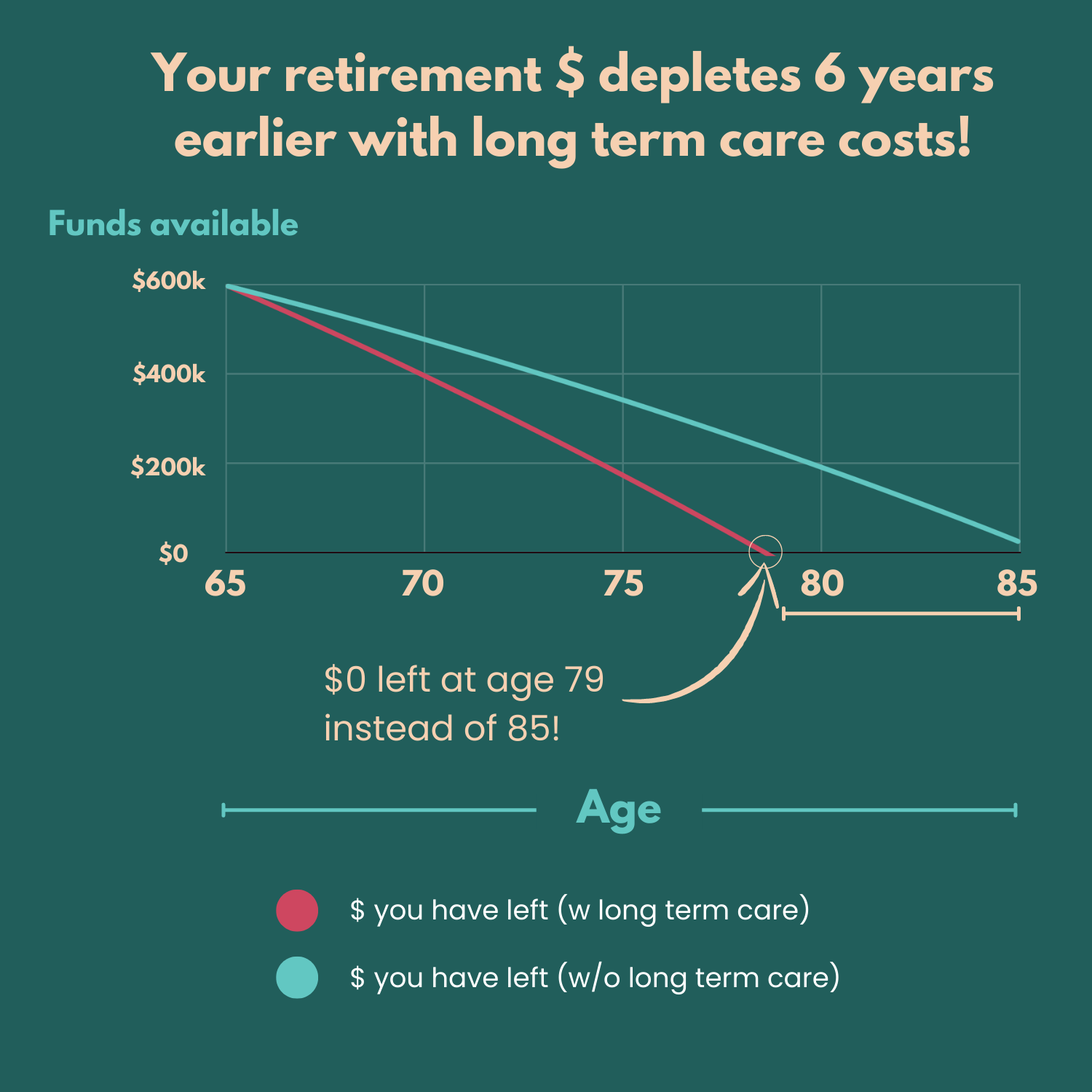

For illustration purposes only.

Based on my calculations, assuming a $600,000 worth of retirement fund with $2,000/month expenses coupled with long-term care costs, your money will deplete 6 years more quickly.

That’s why, without proper retirement planning, CPF LIFE payouts might not be enough for you.

But of course, each person’s needs are different. These are what I have observed in my experience as a holistic retirement consultant.

Preserving your wealth does not have to focus on legacy alone.

Legacy and retirement planning should go hand in hand.

And I can help you integrate these plans without having to sacrifice one for the other.

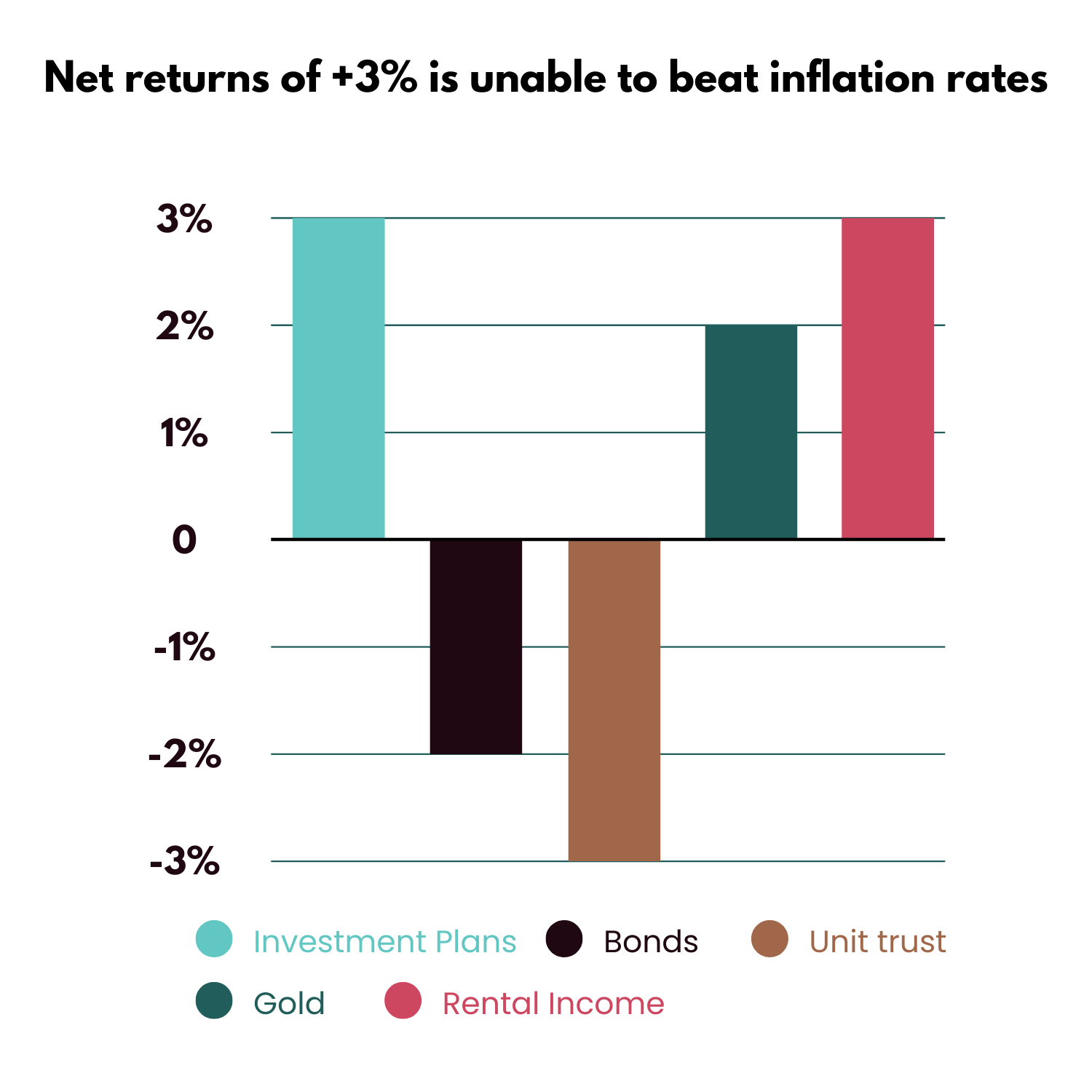

3. Unintentionally Losing Money to Inflation and Interest Rate Hikes

To preserve wealth, some of you might have invested in bonds and other wealth preservation financial assets.

You probably might have bought some savings plans such as endowment as well.

Simon was no stranger to this, too. He had invested in financial assets and bought many savings and endowment plans throughout his life.

I realised that his investments were not strategised as one whole retirement strategy.

His investments were bits and pieces of what could have been a resilient, wealth-preservation strategy.

While he felt that he had already made efforts to preserve his wealth, his wealth was depleting instead due to inflation and market risks.

For illustration purposes, below is how his portfolio fared from June 2021-June 2022 was +3%. While the CPI-All-Items inflation for June 2022 was 6.7%.

For illustration purposes only.

This was because his assets were not integrated as a whole. Assets were not allocated in such a manner that he is able to potentially mitigate these risks.

Hence, the portfolio net return was not able to beat inflation. He was still losing money to inflation despite his investment efforts.

That’s why I am here to share that regardless of which assets you decide to invest in, it is important to consider these factors:

- Can your investments preserve your wealth against inflation and market risks effectively?

- Can you potentially get sustainable lifetime passive income for retirement?

Otherwise, you are actually getting further away from your goal every year.

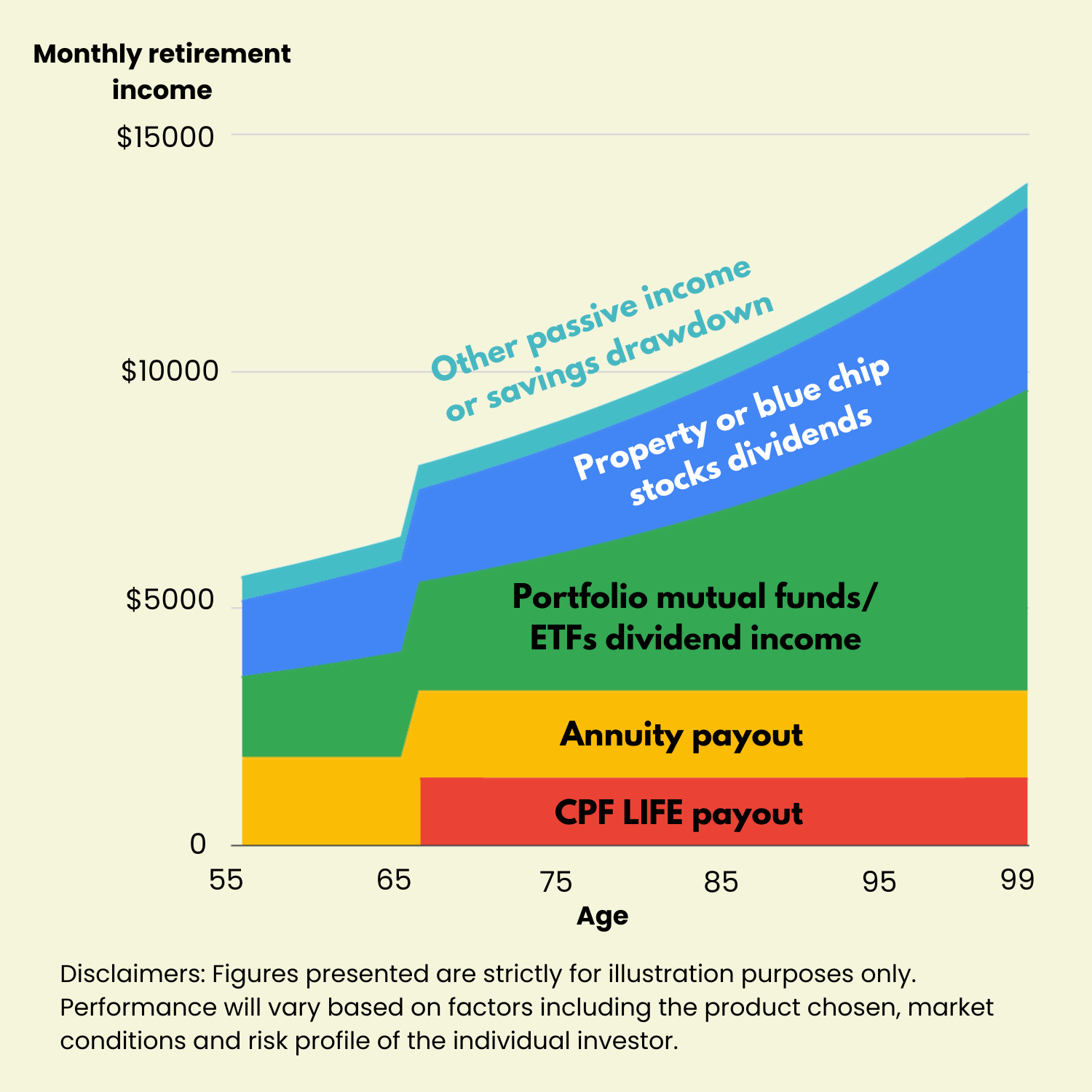

So what does that mean for your investment strategy?

What I am trying to highlight is the importance of doing holistic retirement planning that is tailored to your financial needs.

This way, all of your investments are accounted for and strategised towards your goals. Your retirement nest egg can be potentially preserved despite any economic changes.

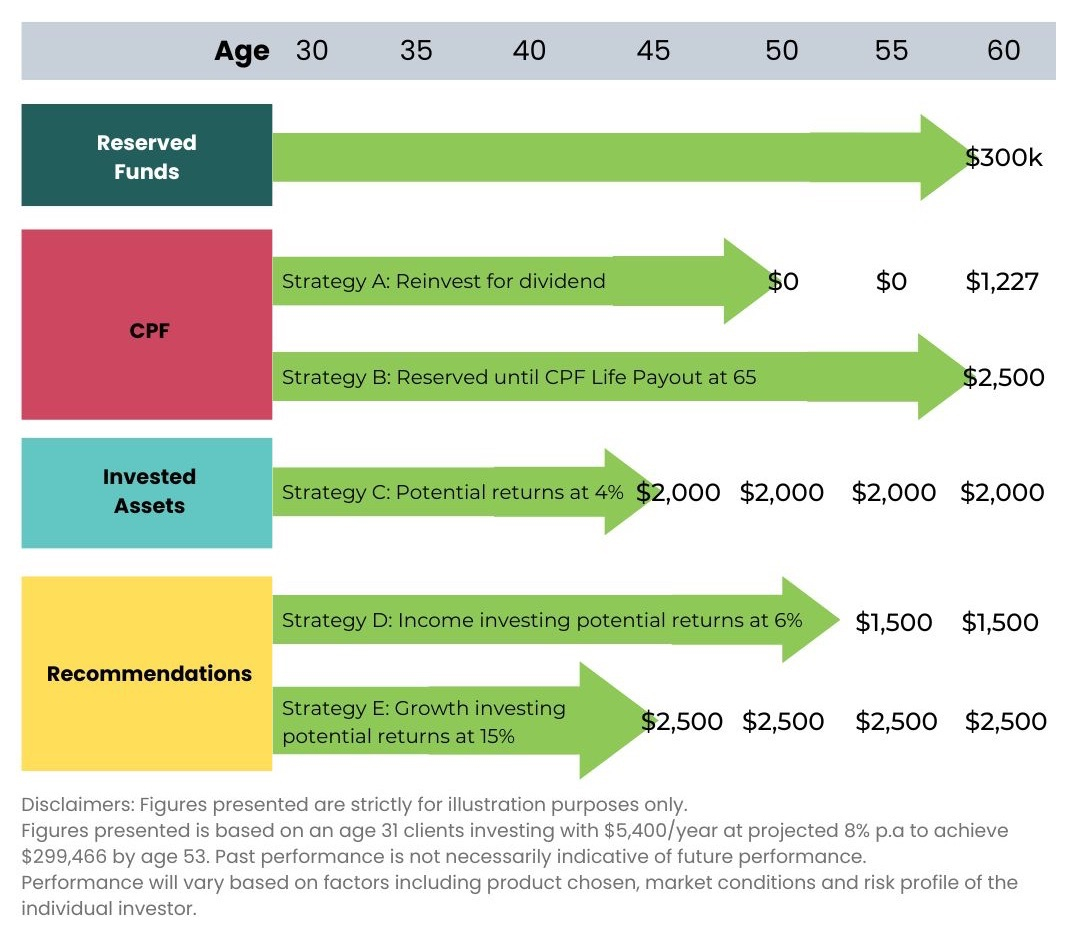

I usually work with my clients using a wealth-optimisation framework to maximise the potential value of their investments and unlock more cash flow:

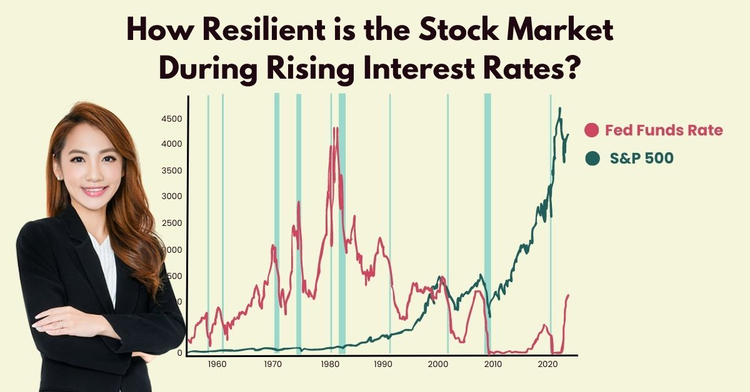

With this framework, you can be assured that your retirement planning has the potential to beat inflation and offset the potential impact of rising interest rates.

This is exactly what I can help you with.

Many of my clients are mass affluent pre-retirees and retirees.

Those who are already retiring are doing so comfortably with the regular passive income they are looking for. Those who are retiring soon are on track to retire earlier than planned.

With my 8 years of experience working with more than 100 mass affluent families to potentially retire earlier with their desired income, I will be able to help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.