What you don’t know about increasing retirement payouts on top of CPF LIFE

Retirement planning, Passive income, Investment • 2022-06-21

Have you imagined what your retirement life may look like?

Is that life possible or it is just something you wish you have?

There is a difference between dreaming about the ideal retirement life versus a realistic, solid plan to achieve it.

We as Singaporeans are very fortunate – many of us are eligible for CPF LIFE, for which we can depend on to give us regular payouts for retirement.

It is usually the default retirement scheme for most Singaporeans.

We put our money, let it grow, and eventually get passive income during retirement.

The concept is very straightforward.

However, although CPF LIFE is a great wealth preservation scheme, retirement can be complex as it is different for everyone.

Some people want to retire much earlier while some don’t. Some want to live a simpler lifestyle while some aims for luxury — which most of the time require more than just CPF LIFE payouts.

Are your CPF payouts enough for you? Would it be enough for you in the future based on your ideal retirement goals?

Here are some factors to consider regarding your retirement payouts and potential solutions you can explore to achieve not just what you need but also what you want for retirement.

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Your returns in CPF may actually fluctuate

Although the government had maintained the minimum CPF interest rates of 2.5% for your Ordinary Account and 4% for your Special Account for many years, it is easy to assume that the rate of returns would always remain the same.

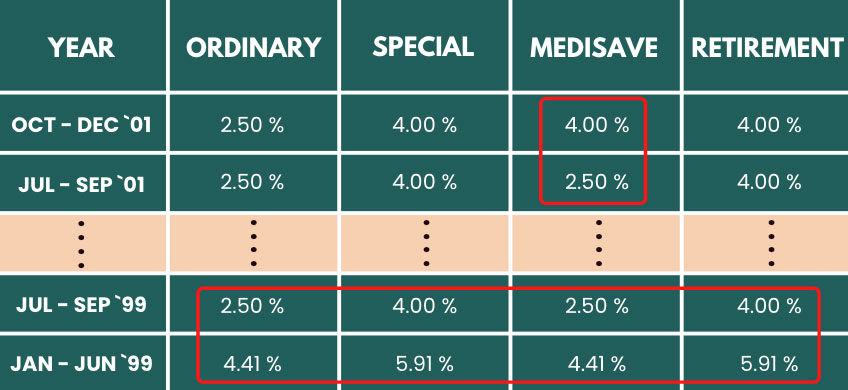

However, there have been instances when it was adjusted in the past:

Source: CPF. Please note that only certain instances of fluctuation in interest rates are shown. For illustration purposes only.

Based on the table above, historically, the interest rate paid out to CPF members in 1999 was reduced.

And in 2001, you can see that the MediSave Account minimum interest rate had a bump to 4% from 2.5%.

From here, we can see that the rates are not set in stone and the government has the right to adjust the rate of returns.

That’s why although your CPF OA and SA returns are set at a certain rate for now, we should never out rule the possibility of not getting the same interest on your CPF accounts over time.

What if you want to retire earlier than 55 years old?

It is a known fact that you can only access your CPF money when you’ve reached 55 years old.

As such, money in CPF can’t be cashed out for any short-term needs.

So while knowing it is an illiquid investment vehicle, what can you do if you are planning for earlier retirement?

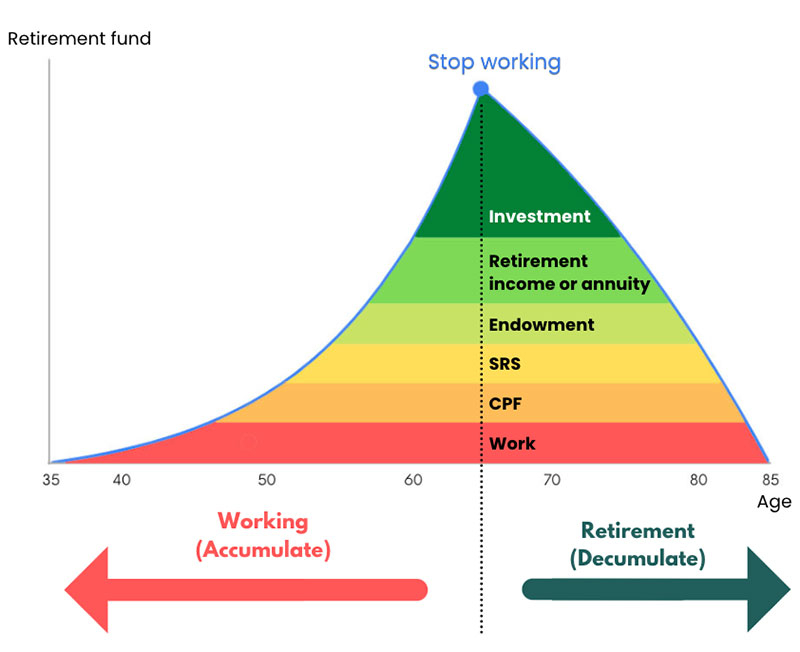

You can actually explore other additional sources of income so through investing in a diverse set of financial instruments. These sources of income can provide you with more flexibility and liquidity.

For example, there are Whole Life Plans that can potentially give you a regular source of income but the payouts may commence at your desired age!

Please note that terms and conditions may vary across different providers.

Moreover, you can also tap into dividend income investing to potentially create multiple passive income streams for your retirement.

This way, you can potentially earn enough to retire earlier before 55 years old.

And with more liquidity, you can have more financial flexibility for any major milestones in the near future – such as financing your child’s tertiary education, which can be costly.

Subsequently, these passive income streams will potentially be able to supplement your CPF LIFE payouts from 65 years old onwards, resulting in more retirement income!

This is what I have been doing for my mass affluent clients, so if you are keen to expand your sources of retirement income and potentially retire earlier, reach out to me for a free financial assessment today.

Are you planning to pass down wealth to your loved ones?

Another very crucial question you need to consider in retirement planning is, is passing down the money to your loved ones (after you pass on) important to you?

Assuming that you are on the CPF LIFE scheme, and you intend to pass down your wealth, you must consider these two things:

- How much do you plan to pass down to your next-of-kin?

- How much do you need for retirement?

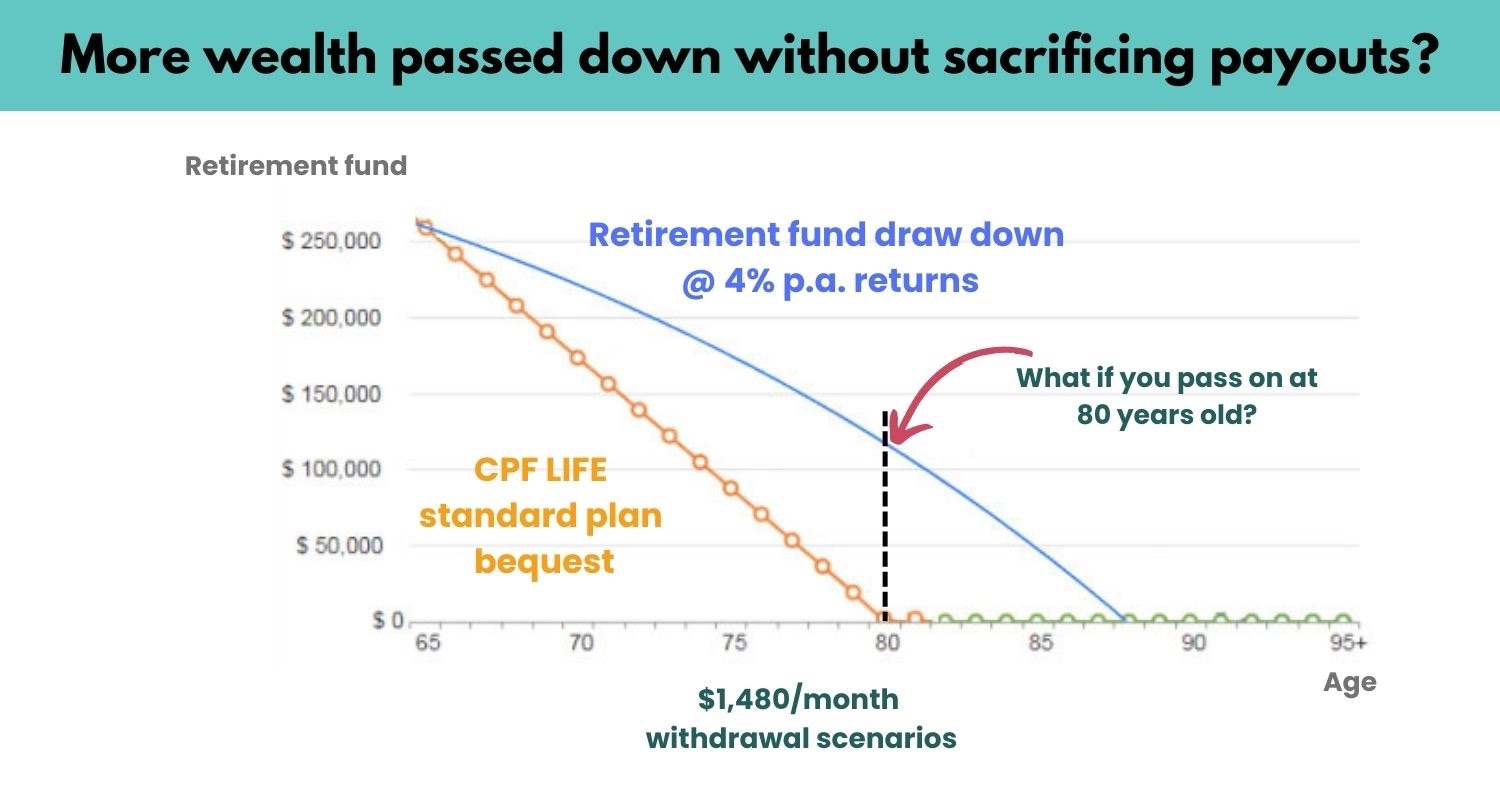

For illustration purposes, let’s assume that you contributed CPF savings worth $270,000 to your CPF LIFE premiums at 65 years old.

CPF LIFE premiums paid can potentially earn up to 6% interest p.a on the first $30,000 of their combined CPF balances, and up to 5% on the next $30,000, while the remaining may earn up to 4% – but do note that this rate may fluctuate and is not guaranteed.

However, for the purpose of this illustration, let’s assume that premiums earn 4% p.a returns throughout and that you are withdrawing your CPF LIFE monthly payouts using a standard plan. After you have withdrawn $1,480/month from 65 years old to 80 years, you should still have about $127,267.52.

But the reality is that the bequest amount could potentially be zero.

Source: CPF

Why is that so?

Here is what many of us might miss — our beneficiaries are entitled to what’s left in our CPF LIFE premium balance (which means only the principal sum, not including interest earned from our CPF LIFE premiums) and CPF savings only.

By the age of 79, you would have received up to $270,000 worth of payouts, which is equivalent to the amount that was transferred from your RA to CPF LIFE as CPF LIFE premiums.

Under the CPF LIFE scheme, your monthly payouts will come from the premium you paid and if they are depleted before you pass on, you are still entitled to lifelong payouts.

Since you have utilised all of your CPF LIFE balance and CPF savings, there will not be any amount left to pass down to your family, so your bequest amount may actually be $0 by that time.

You might be wondering… What happened to the interest earned on top of your CPF LIFE premiums?

Under the CPF LIFE scheme, the interest returns gained will actually be pooled into a fund along with all other CPF LIFE members — this is to ensure lifelong payouts for CPF LIFE members for as long as they live.

This brings us to the next point:

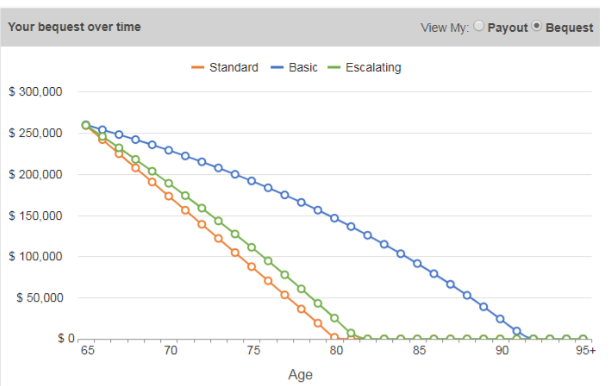

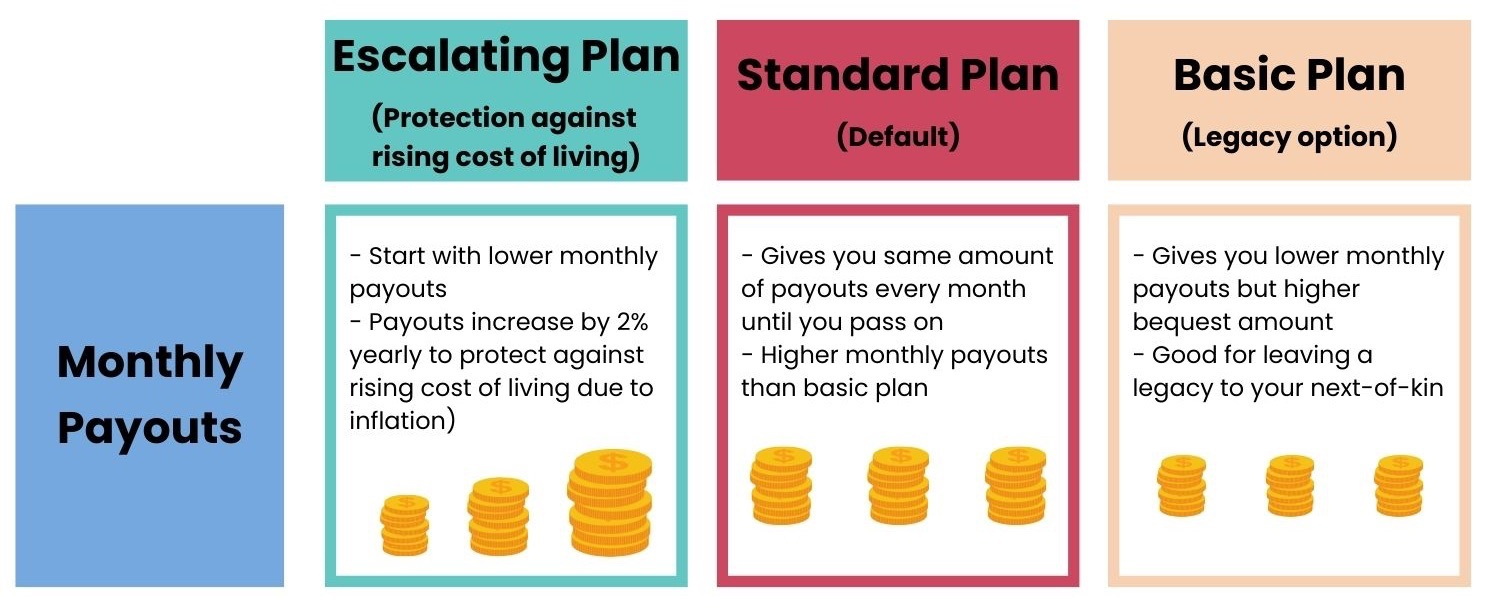

Since both our payouts and potential bequest amount are dependent on our CPF savings, we have to be mindful of the CPF LIFE plan we choose.

For example, if you want to increase the amount you want to pass on to your next-of-kin (the bequest amount), some people may consider the Basic Plan as it offers lesser payouts but with leaving a legacy in mind.

Source: CPF

In short, you may need to receive less retirement income for the sake of passing down more wealth to your family. And vice versa.

So, how do we find a balance between getting our desired retirement income and leaving a legacy for our loved ones?

If passing down wealth is important to you and you don’t wish to compromise your retirement payouts as well, consider diversifying your retirement funds into other financial tools that can potentially grow generational wealth for you and your family.

And this is exactly what I help my clients to achieve.

Many of my clients have found the balance between generating the potential passive income they need and growing multigenerational wealth. They have achieved it through careful and comprehensive retirement planning, which I can help you to do.

What are your needs and wants when you retire?

Retirement is often the time when many people feel that they can take a step back from hustling to enjoy the finer things in life. So surely you don’t just want to consider your basic needs alone.

Do you need to factor in expenses for your entertainment and travel? Your retirement years are, after all, the time for you to rest and relax!

Also, we might not like to think about it, but as we get older, it is inevitable that some of us might require long-term care.

This can be quite costly, and what you need might range from requiring a personal caregiver to checking into a home facility centre.

This is why you may want to consider strategically growing multiple sources of retirement income that can supplement your CPF LIFE payouts, using a comprehensive mix of different financial instruments, or even other whole life plans.

You can even potentially retire early and receive passive income through these other sources before you are eligible to receive your CPF LIFE payouts.

And your CPF LIFE payouts can be supplemented with these other sources of income by the time you reach 65 years old.

But of course, doing so requires a good strategy, proper asset allocation and diversification tailored to your goals and risk appetite.

On top of that, you may also strategise your investment portfolio towards achieving returns that potentially enable you to transfer the desired amount of wealth to your loved ones.

Many of my clients are mass affluent pre-retirees and retirees.

Those who are already retiring are doing so comfortably with the regular passive income they are looking for. Those who are retiring soon are on track to retire earlier than planned.

With my 8 years of experience working with more than 100 mass affluent families to potentially retire 10-15 years earlier, I will be able to help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

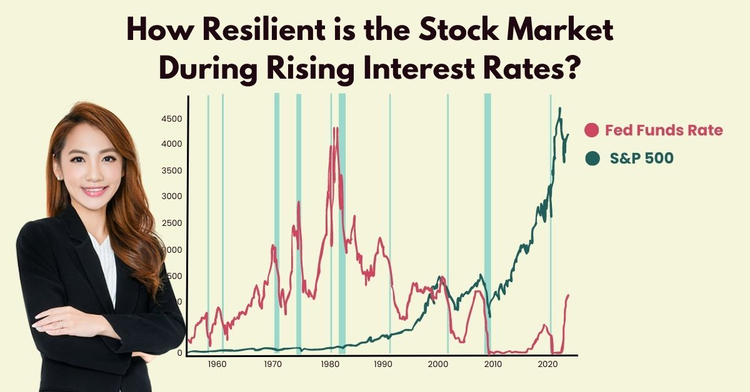

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.