Retiring soon? Why this popular withdrawal strategy is dangerous to follow blindly

Retirement planning, Investment, Passive income • 2022-06-07

For someone retiring soon, I am sure you have wealth built up for your golden years.

Soon, you are able to turn your savings into paychecks! Well deserved paychecks — from the past you to the future you.

But, have you ever thought about how much can you really withdraw and spend from your retirement funds to make it last… a lifetime?

The uncertainties that come with retirement can make preparing for retirement much more complicated than it already is:

- What if you live you live longer than expected?

- What if you need more medical and long term care costs?

- Do you live life to your heart’s desire or bear the burden of not living it?

And the last thing you want to happen during retirement is not having enough money.

Is it possible to have financial flexibility and freedom during your retirement years without having to worry about running short of money?

We sure don’t want to be scrimping and saving even during retirement years.

So how can you avoid it?

First, you need to look into your withdrawal strategy – this is the strategy you use to withdraw your money from your retirement funds (such as your investments) to be used as passive income during your retirement years.

Yes, you need to withdraw with a strategy – otherwise, you may not end up not having enough money that can last as long as you live!

So what kind of withdrawal strategy should you use to potentially achieve a balance between financial freedom and financial adequacy?

Let’s look at two types of withdrawal strategies – one commonly used and one lesser known – and analyse which is actually more suitable for your retirement journey.

Jump in!

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

The 4% withdrawal strategy — is this really the holy grail rule?

You might have heard of this popular strategy – the idea behind it is that you withdraw 4% every year (adjusted for inflation) from your nest egg as retirement income, and your retirement fund will be able to last you for 30 years.

Historically, the 4% rule generally recommends maintaining a portfolio of 50% stocks and 50% intermediate-term Treasury bonds, though some financial experts have also advised having a different allocation for retirement, such as less exposure to stocks.

The logic behind this 4% withdrawal rule is assuming you will grow back what you withdrew for retirement over the course of the year, after adjusting for inflation. By taking out less than what you earn from your investments, your retirement funds could potentially last for around 30 years.

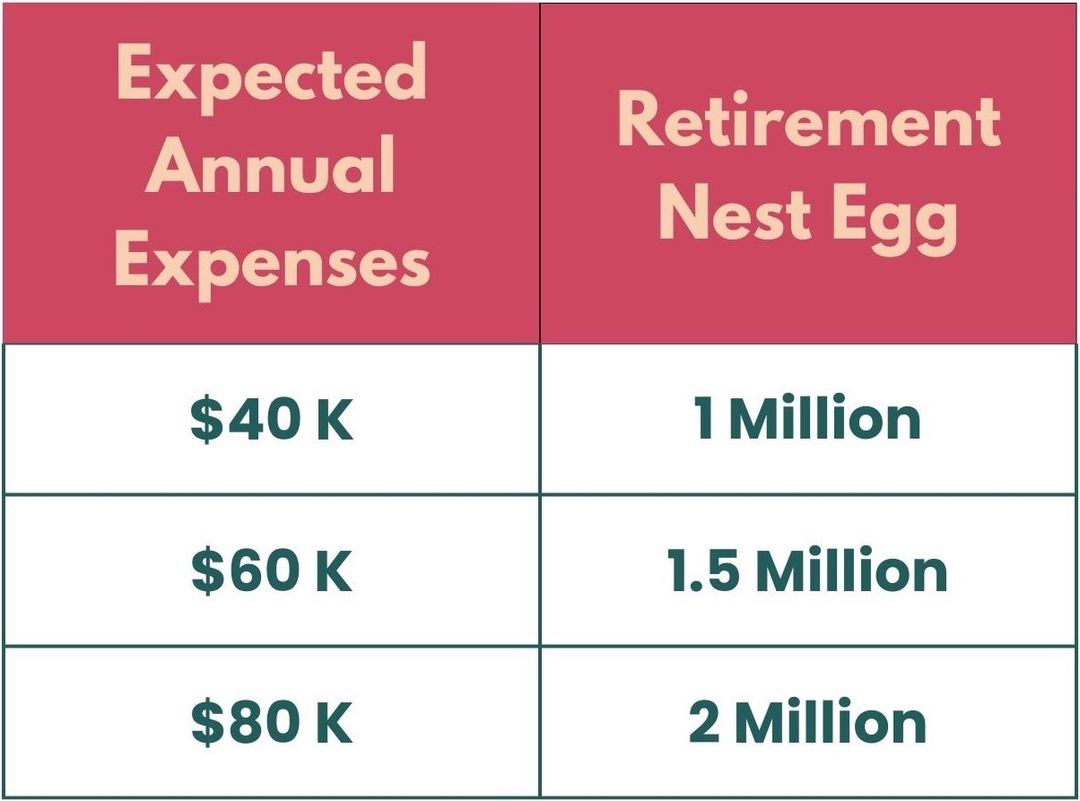

For example, if your retirement nest egg is worth $1 million, you are able to withdraw $40,000 yearly. If you need more than $40,000/year, you will need to invest in assets that can potentially generate that amount of returns for you.

With this strategy, these are the expected amount of retirement funds you might potentially need, based on your expected expenses:

For illustration purposes only.

It is a good strategy, but is it suitable for you?

These are three factors you need to consider:

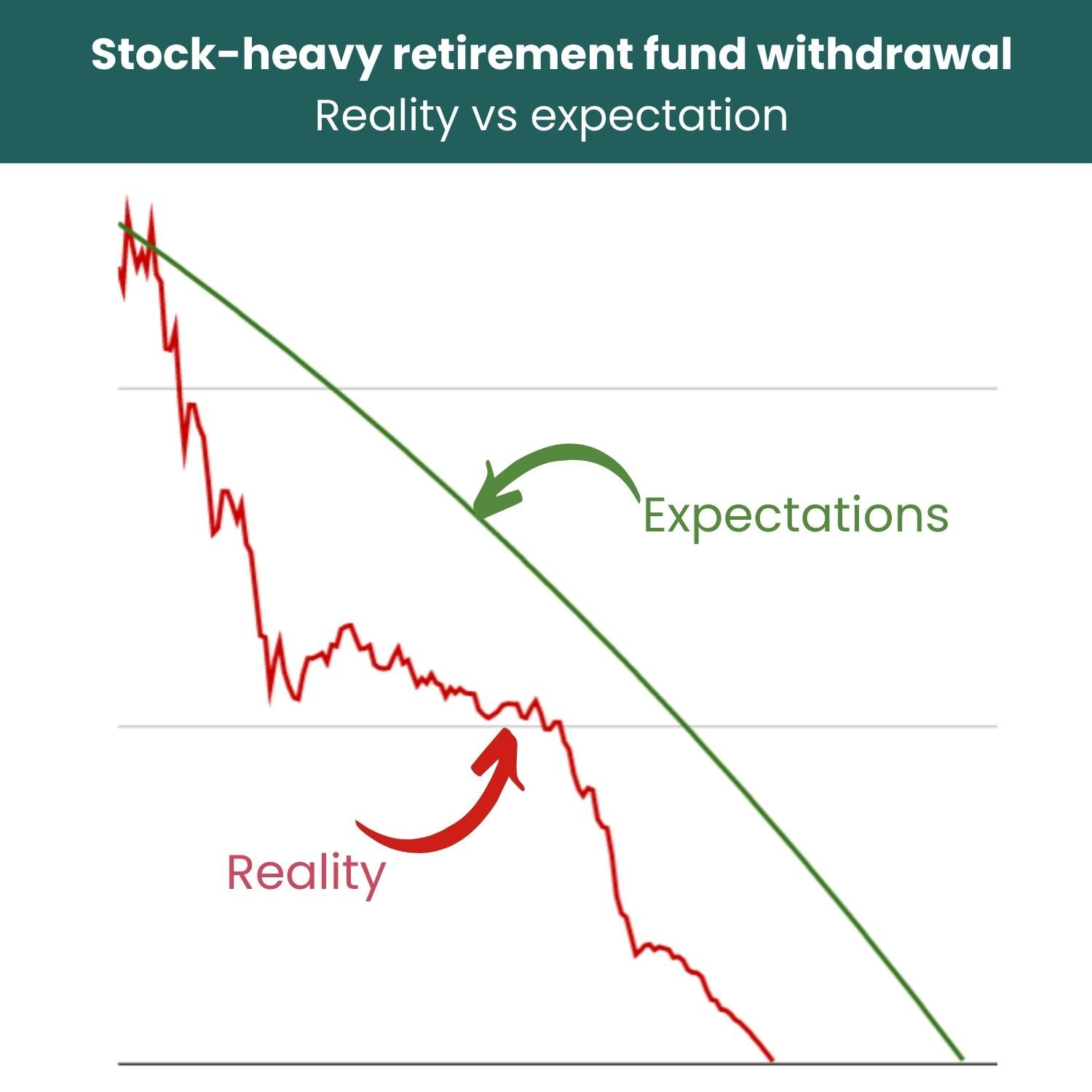

1. Will your portfolio always give you 7% returns? The 4% rule ignores market performance

The 4% rule suggests that you can withdraw 4% consistently, given that your portfolio will earn about 7% p.a. and thus, replenish back your funds.

The Trinity Study, from which the 4% rule came about, was done based on the market’s performance from the year 1926 to 1995 and assumes that the market will continue to perform at a similar rate.

As many of us already know, the market’s performance is never guaranteed and things can turn out to be beyond our expectations.

What happens if our portfolio is not able to hit the 7% p.a. returns consistently? Or worse, what if we get negative returns?

Would it still make sense to withdraw 4% from your portfolio in a market downturn?

What if the downward trend of the market continues for another 3 years?

For illustration purposes only.

Doing so could possibly affect the longevity of your retirement nest egg.

2. Is the required asset allocation suitable for you?

For a better success rate of this strategy, so that your retirement fund can potentially last for 30 years, it is potentially better for the investment portfolio to consist of at least 50% stocks.

However, this specific asset composition might not be suitable for everyone. What if you prefer to have less volatility in your portfolio and a smaller allocation to stocks?

For illustration purposes only.

An investment portfolio should be tailored to every individual’s financial goals and risk appetite. And every individual’s needs are different.

Based on my professional experience, asset compositions in a client’s portfolio may also change over time. This is because a change in lifestyle may eventually lead to a change in financial needs.

Also, during our retirement years, there may be instances when we may need to fork out more money for long term care, medical care, etc.

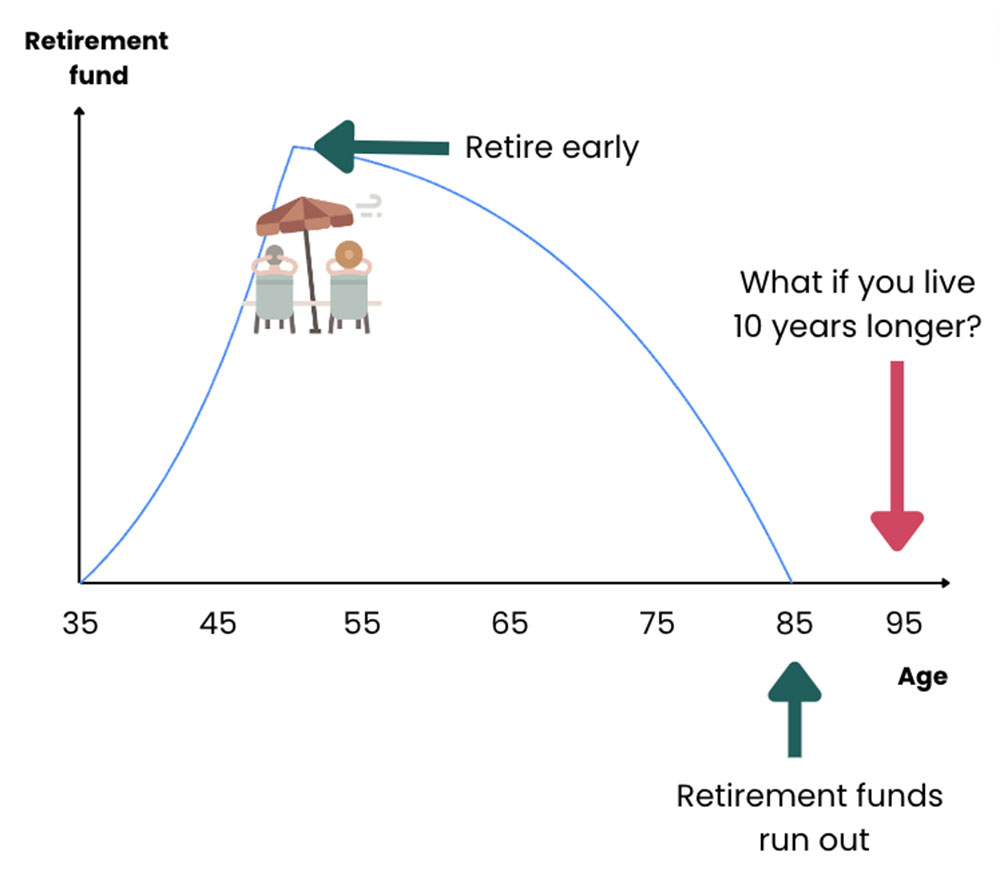

3. What if you retire earlier and you live longer?

The 4% strategy assumes a 30-year horizon. What happens if you would live longer than 30 years after your retirement? This hypothetical time horizon for this strategy might not be applicable.

For illustration purposes only.

It is better to prepare for the possibility. As such, you would need to have a different approach to withdrawing your retirement fund to ensure it will last you as long as you live.

Or are you planning to retire much earlier? If so, you may want to re-assess your investment as well as the expected withdrawal strategy that will potentially help you to achieve it.

My clients are potentially on track to retire 10-15 years earlier with withdrawal strategies that are tailored to their goals and needs. If you are keen, feel free to reach out to discuss what retirement investment strategies may work for you.

Percentage of portfolio rule — should you just cash out your gains and hold back during losses?

Next, there is another strategy that I find worth discussing. The percentage of portfolio rule suggests taking out all of your positive gains when your portfolio gains and holding back completely when your portfolio experiences losses.

It can be seen as a good approach as theoretically your portfolio cannot be depleted (because you are only cashing out your gains).

This rule assumes that:

- Your portfolio is diversified across asset classes.

- The asset classes are diversified across industries and geographies.

Thus, by withdrawing only positive returns, your capital can never be zero.

Would this be a better withdrawal strategy?

Here are some considerations:

1. This strategy is not suitable if you need consistent retirement income

As the rule suggests, you should not withdraw cash from your retirement fund if your portfolio is experiencing losses.

However, it is generally understood that the market is volatile, so it is normal to experience gains and losses as part and parcel of volatility.

But if you follow this rule, it means that you will not be able to withdraw anything if your portfolio is experiencing losses.

This is fine if you have other sources of passive income to supplement and you don’t need a consistent source of passive income from this portfolio.

But if you are depending on this retirement fund for your fixed monthly expenses, it can be quite stressful during times when you can’t make any withdrawals.

Can the previous positive returns cover your expenses during a market downturn?

2. Do you have time on your side?

Since the rule suggests withdrawing only when your portfolio is making positive returns, what if you are experiencing a prolonged period of market downturn and your portfolio is in the red for months or even more than a year?

How long can you hold off withdrawing money for your retirement expenses in that case?

And as retirees, you don’t have the luxury of time in the market to ride out the volatility in the long run.

Many people might prefer to have a greater sense of security and have a more consistent source of passive income, to ensure that their monthly fixed expenses are covered during their retirement years.

So this withdrawal strategy might not be suitable for you if you are looking for more predictability in terms of passive income for your retirement.

After running through both strategies, you would be able to get a better idea of the kind of factors that are important to consider in your withdrawal strategy – from market performance, personalisation of asset composition, to the sense of security in retirement income.

So, how do you know which strategy is best for you?

Before choosing a withdrawal strategy, you must first know your needs and what your portfolio can potentially help you during retirement.

1) Identifying basic expenses – include this ONE important cost most people miss

Break down your expenses into several categories so you can have a better idea of what you need (and what you want), and how much passive income is required to cover these.

1. Fixed expenses and daily necessities

This includes your daily needs like food and groceries, rent, utility bills, transport costs, etc. These are costs that you likely can’t reduce.

2. Variable costs and luxuries

This includes the extras you might spend during your retirement, for example, luxuries like travelling, entertainment, hobbies and many more. This is unique to each individual as everyone’s lifestyle is different.

These are costs that you are likely able to reduce if required.

3. Potential long term care costs

While most of us will be able to pay for most of our medical and hospitalisation costs by Medisave, MediShield and/or get them covered by our hospitalisation insurance plans, there’s one important cost we often miss or underestimate – long term care.

This cost goes beyond medical care alone.

What if due to critical illnesses or disabilities we are unable to perform our daily activities such as eating, dressing or going to the washroom?

What if we need a private nurse or a caregiver to help us with our daily needs, meal preparations and so on? What if a family member needs to give up their jobs (and hence income) to be the caregiver?

The costs can add up.

You should not take this possibility of needing long term care lightly. Learn more about long term care costs and what you can do about them here.

Don’t miss out potential costs in your retirement planning that might deplete your retirement funds earlier.

Working with experienced Financial Adviser Representatives (FARs) can make your life easier. As a retirement wealth specialist, I specialise in helping mass affluent retirees and pre-retirees achieve their desired financial goals for retirement. Find out more here.

2) Prepare your investment portfolio for the worst

Do you know you can craft your investment portfolio to ensure that your fixed expenses can be covered?

You can still get potentially regular passive income, even during a market downturn.

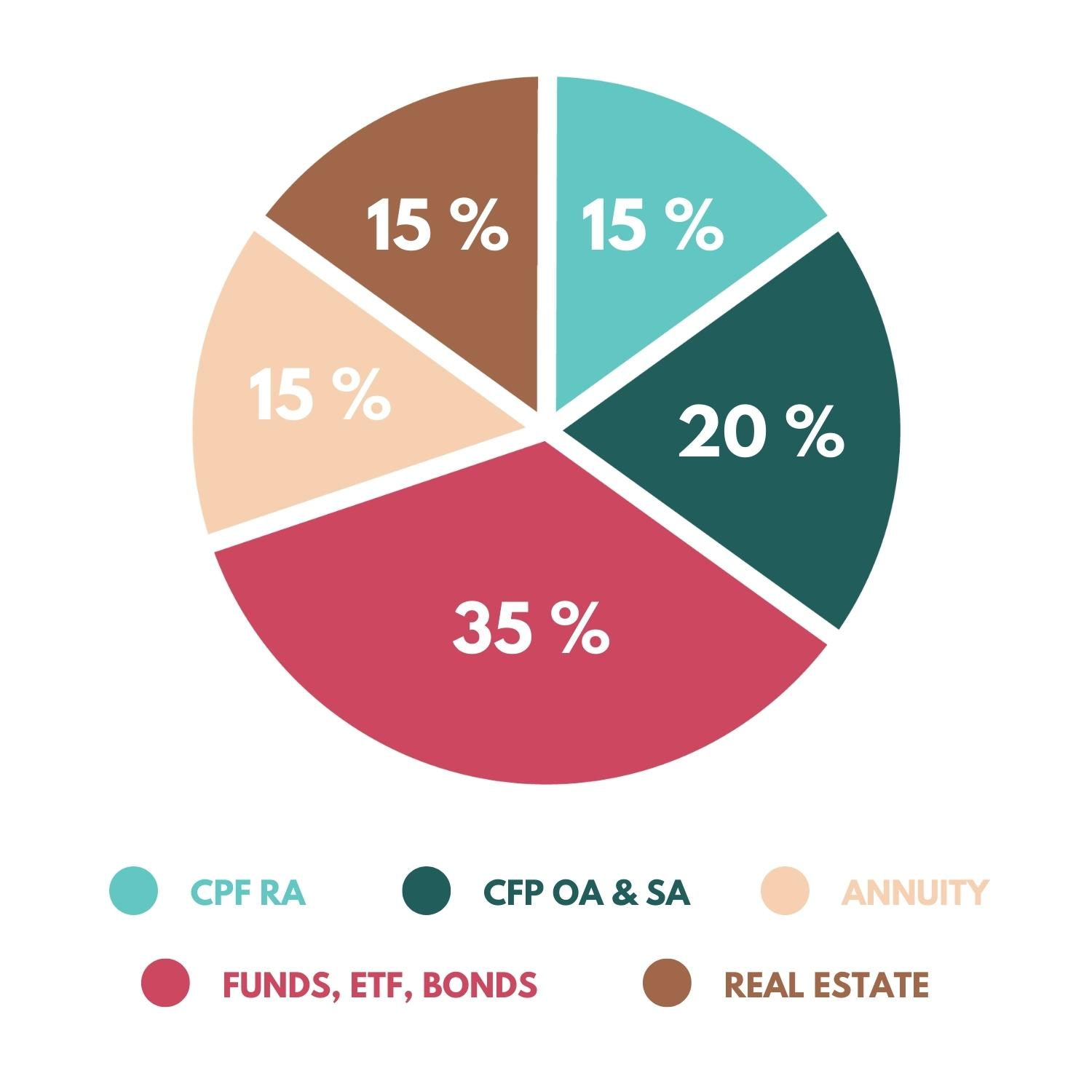

This can be done by strategising the type of asset classes you have in your investment portfolio. For a clearer picture, take a look at the portfolio composition below:

For illustration purposes only.

This is a brief illustration of one of my High Net Worth clients’ retirement portfolio.

Based on this asset allocation, you can see that he is invested in several financial instruments that can potentially provide him with regular passive income during his retirement.

For example, the client has CPF LIFE payouts, and supplemented his fixed income through pension schemes and annuities (these can be Whole Life Plans that can potentially last you a lifetime).

These assets are designed to provide him with regular passive income (to a certain extent) over a certain period of time.

This way, you can retire with greater peace of mind so that even during market downturns, you are still potentially able to get a certain amount of cash inflow.

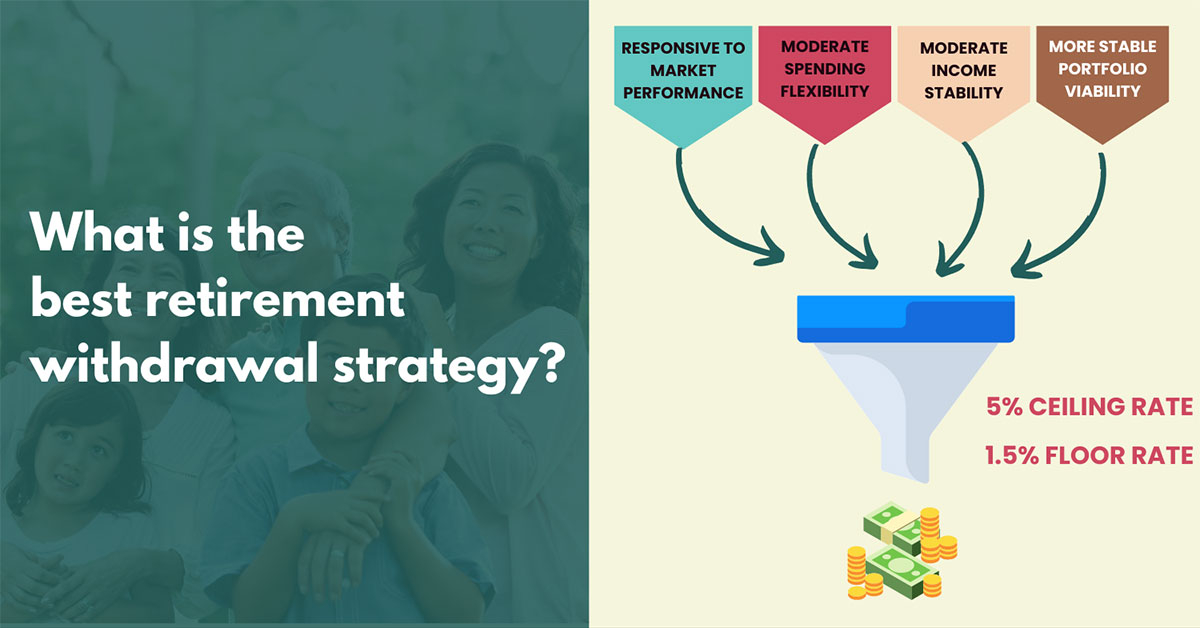

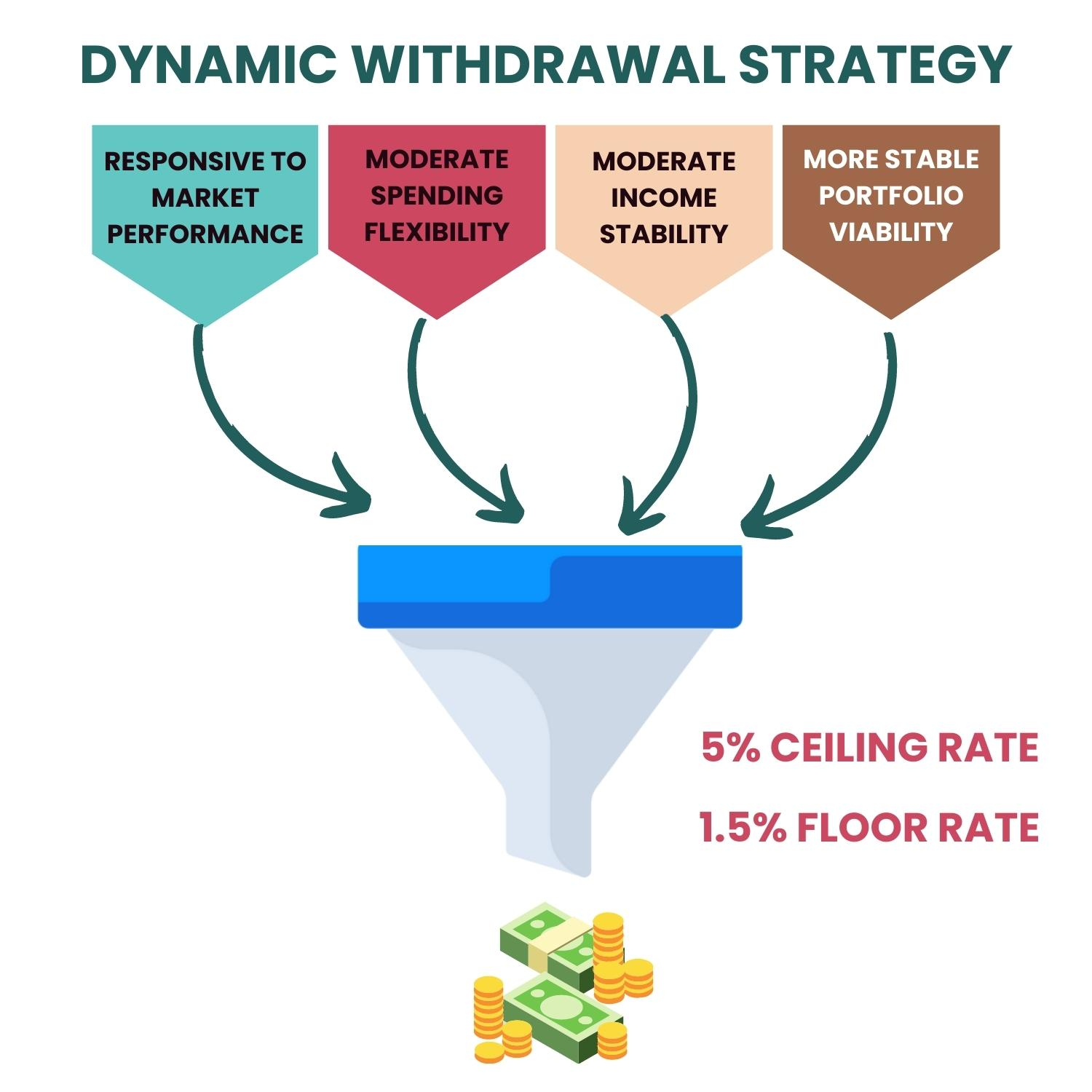

The best of both worlds: Dynamic withdrawal strategy

After what has been said, you probably now have a better idea of what kind of withdrawal strategy may suit you.

Both the 4% rule and the percentage of portfolio rule can be great strategies.

However, there is another withdrawal strategy which is a hybrid of the two strategies – Vanguard’s Dynamic Spending Rule. This strategy is more flexible and it allows retirees to have a solution that is more tailored to their own goals and needs.

This rule allows retirees to set a dynamic range of percentages for withdrawal every month. The rate of how much they can withdraw may fluctuate based on the previous year’s performance outcome.

Here’s how it works:

For example, when your portfolio performs well, you only withdraw 5%, and if your portfolio is not doing well, you take 1.5%. The 5% is your ceiling rate and the 1.5% would be your floor rate. This range would be adjusted to inflation as well.

This way, you don’t need to reduce your spending significantly even when the market is down, yet you can still preserve your capital to a large extent so your invested funds can potentially last longer.

And when the market is up and profitable, you cap your spending at an acceptable level (i.e. 5% in this example), so you can save the rest of your profits for a rainy day.

For illustration purposes only. Ceiling rate and floor rate to be adjusted according to the individual’s needs and risk profile. The rate for every investor might be different.

The ceiling and floor rate as to how much you can withdraw should be tailor-made according to your needs – find a range that is viable for you in the long run.

It is all about finding the right balance. You don’t want to overspend in your earlier years which can leave insufficient funds for the future. But at the same time, you don’t want to be too prudent either by not living your life to your heart’s desires.

The complexity of such planning might call for professional input and guidance, so that you can get a better idea of how much should you withdraw after considering your portfolio value, time horizon and financial goals.

As an FAR, I am able to recommend to you withdrawal strategies that can help you find the balance that you are looking for.

Many of my clients are mass affluent pre-retirees or are already retiring. Those who are already retiring are doing so comfortably with their desired regular passive income.

Those who are retiring soon are on track to retire earlier than planned.

With my 8 years of experience working with more than 100 mass affluent families to help them potentially retire 10-15 years earlier, I will be able to help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

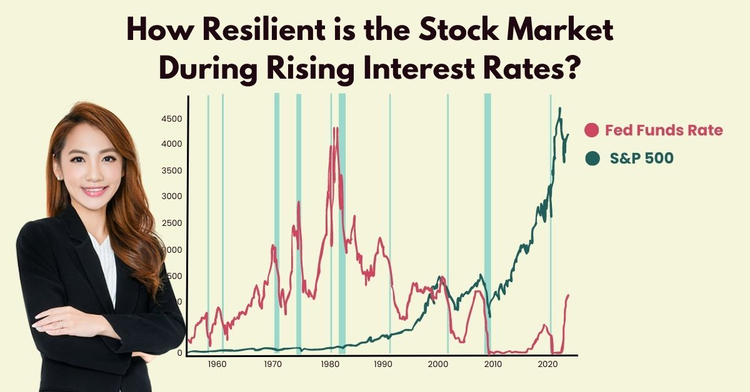

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.