Is there a reliable alternative to property investing?

Retirement planning, Investment, Passive income • 2022-05-04

Retirement planning is very interesting.

As someone who had helped more than 100 mass affluent families get on track to retire 10-15 years earlier than expected, I can say that each individual’s plan differs from the other.

One of my clients – let’s call him Gary (not his real name) – has quite an interesting experience with his retirement planning.

He was a pre-retiree in his 50s and looking for something easy that is able to give him a steady stream of passive income over time.

Gary shared that while CPF Life already provides stability of income, the payout of $1,500+ a month from age 65 onwards is insufficient for his current lifestyle. If possible, he wanted to retire comfortably without making any adjustments to his lifestyle – and preserve his purchasing power even as inflation increases.

He was also looking for something he can benefit from without having to wait till he reaches 65 years old.

He had a lump sum amount of money that he wanted to put to good use.

Gary was aware that he needed to make his money work for him, especially in preparation for retirement. This was a good start.

But Gary’s concern was that he does not know exactly what to do.

So, I asked further:

Do you have an investment and retirement strategy preference?

His preferences for a retirement strategy were as below:

- Certainty: He was looking for something straightforward that can provide him with consistent passive income during retirement.

- Legacy: He also wants to pass on the wealth he worked hard for as a legacy to his loved ones.

- He tried investing in some funds but he doesn’t really know how to manage his investments.

As a father, Gary is also a businessman. Almost all of his time is occupied and he might not always have the time to manage his finances in a very detailed manner.

Don’t have enough for retirement? Many Singaporeans are asset-rich but lack strategy to generate passive income. At The Fin Lens, I help mass affluent clients keep up with the latest solutions and optimise their assets – so they can build multiple income streams and retire earlier. Find out how today.

Disclaimer: This post represents our personal views and opinions and is neither associated with any organisation nor reflect the position of any organisation. This content is also only for informative purposes and should not be construed as financial advice. Past performance does not necessarily equate to future performance. Please seek advice from a Financial Adviser Representative before making any investment decisions.

Here’s how Gary managed to get consistent passive income with just a simple lump-sum investment:

A route that Gary was considering was property investment.

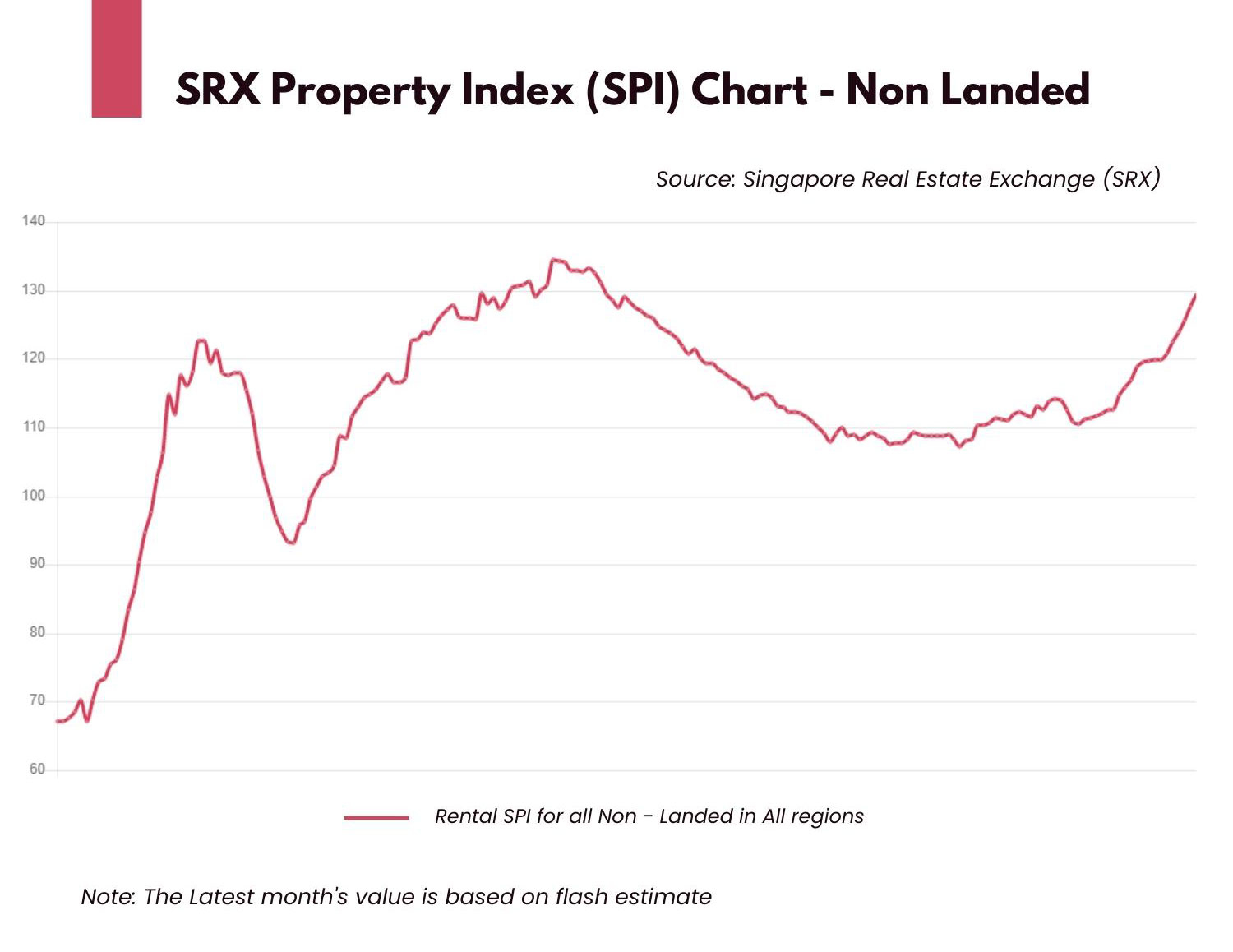

He wanted to buy a property for the purpose of getting rental income during his retirement years. This is a common strategy used by many retirees.

On top of that, he can sell the property before he passes on so the profit can be given to his wife and family.

While it is a viable option, his rental income may vary depending on the prevailing market. Hence, it may not give him the consistent passive income he was looking for.

He would also need to spend time finding a responsible tenant, dealing with the possibility of vacant periods, fork out maintenance costs, agent costs, etc.

These costs could reduce his overall profits from rental income.

Acknowledging the possibilities, Gary asked me if there were any other options out there that he can do.

So I proposed a strategy for Gary that can potentially enable him to get consistent passive income in his entire lifetime.

The strategy includes a type of annuity plan, coupled with a holistic investment strategy.

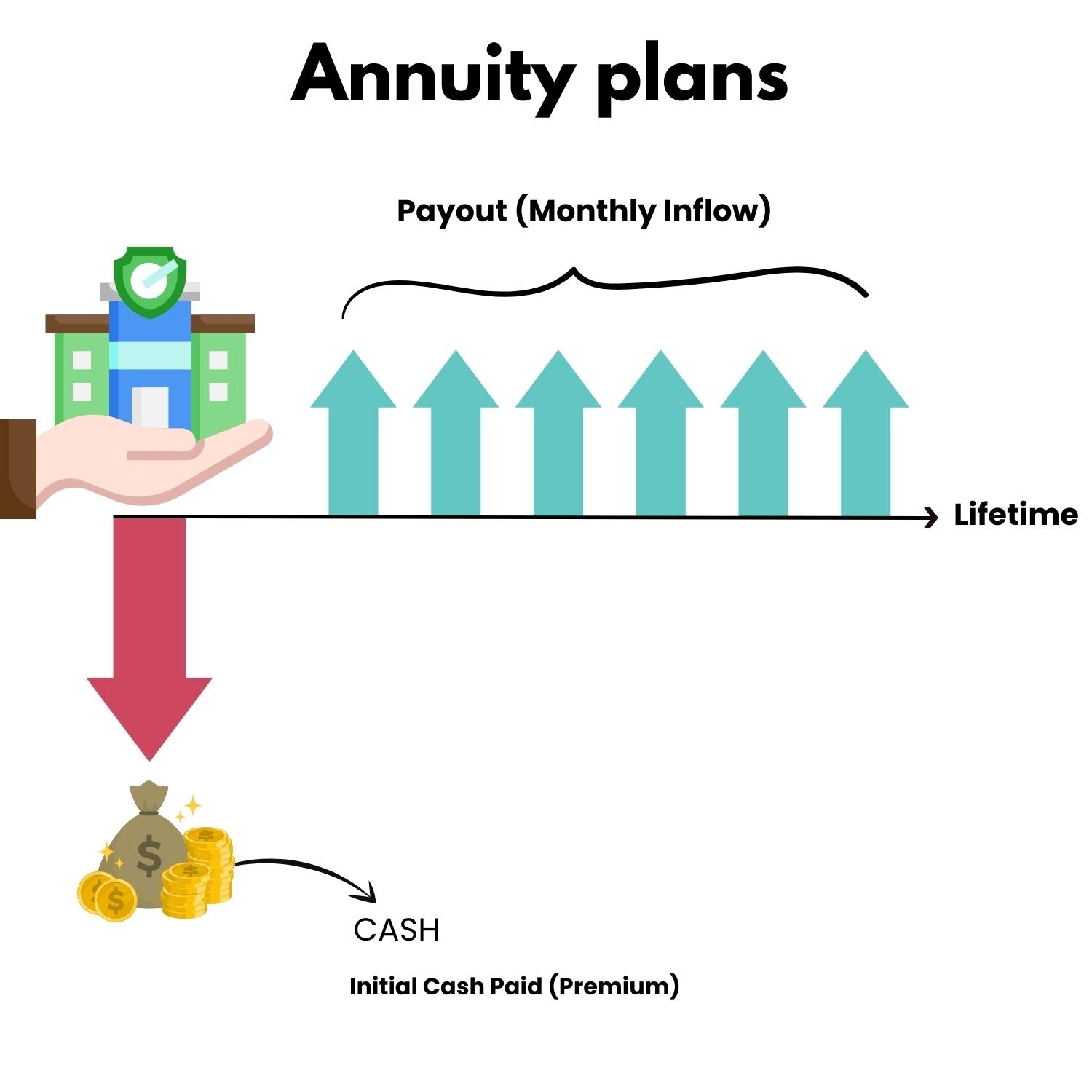

For context, annuities can be seen as a fixed passive income that you can get from a Whole Life insurance product. The focus, however, is not on the protection but rather on its regular payouts.

The payout period varies with different providers, but in this case, Gary considered a lifetime annuity.

How does it work?

Basically, as Gary chose a lifetime annuity, he would need to put in a lump sum and in return, the provider guarantees a certain amount of payment in the future as long as he lives.

So for some annuity plans, this is quite similar to how you might put down the downpayment to buy a property and rent it out for passive income — but on a simpler scale.

It is like another version of earning ‘rental income’ without all that jazz of maintaining the property and getting tenants.

On top of that, a unique feature of some annuities is that it does not touch your initial capital — no drawdown from the money you put in to purchase it. In some cases, the income distributed to you will only be from investment returns from the par investment fund of the respective insurer.

And in those cases, upon death, the next of kin — be it your spouse or child — will be entitled to the guaranteed death benefit which is the total capital paid + benefit.

Hence, some Whole Life annuity plans preserve your capital by:

✅ Having no drawdown from capital invested and still get consistent passive income

✅ Passing total capital paid + death benefit as a legacy to family.

(Do note that there are various types of annuity plans, and what we have illustrated here is only for certain specific ones.)

It was a fitting strategy for him due to the certainty and assurance of future cash flow

As Gary was looking to supplement his guaranteed passive income from CPF Life, his main concern was not wanting to be worried and constrained in spending during his retirement years.

Ultimately, during retirement, you need to prioritise cash flow instead of accumulating wealth. At this stage, a regular income stream holds the utmost importance so that you can retire comfortably without having to worry about expenses.

Here is an illustration of how annuities work:

You may find it similar to property investments in these areas:

- The upfront cash to buy an annuity → your down payment for a new property launch

- The guaranteed monthly payout from the annuity → rental income from the property

But is this investment tool too good to be true? Here are some limitations of annuity plans most people may overlook

Inflation is inevitable and can eat into your returns

I value transparency with my clients. So whenever anyone asks if there are any risks to the annuity plan, I would always share openly and honestly with them.

The effect of inflation is very real.

For annuities, one thing to note is, while your payouts would remain the same over time, your purchasing power would decrease due to inflation.

This means that with the same amount of payouts, over the years, he would be able to purchase fewer items due to the loss of purchasing power.

So to preserve your purchasing power, you need to have a holistic investment strategy that can potentially give you returns that beat inflation.

And as most of you also know, it is never a good idea to put all your eggs in one basket.

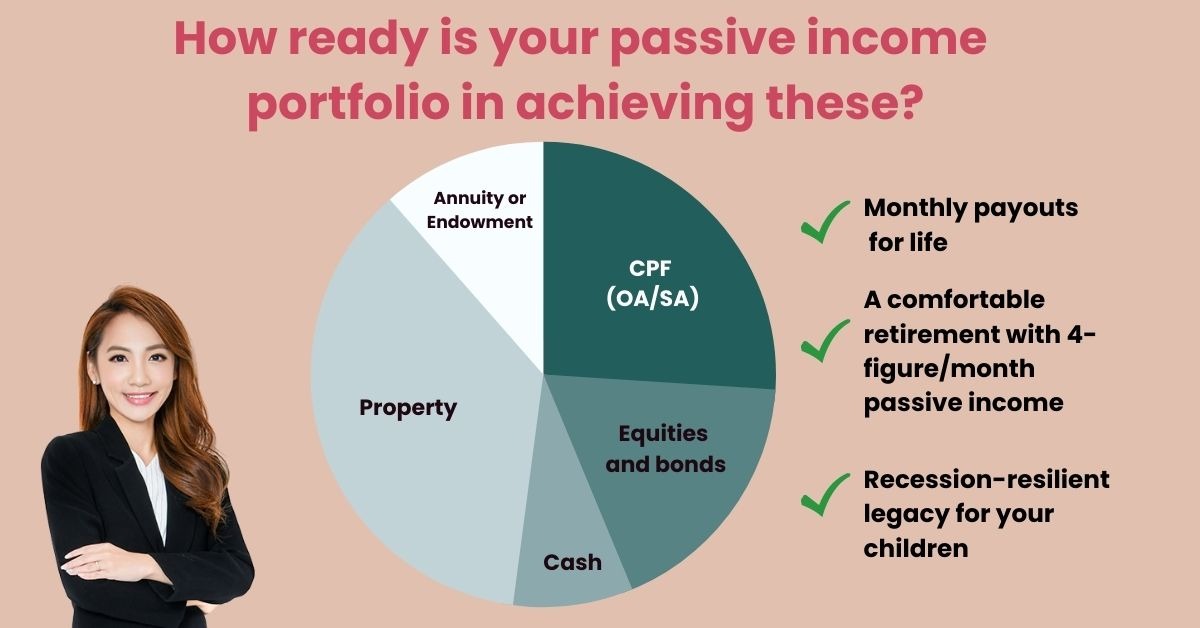

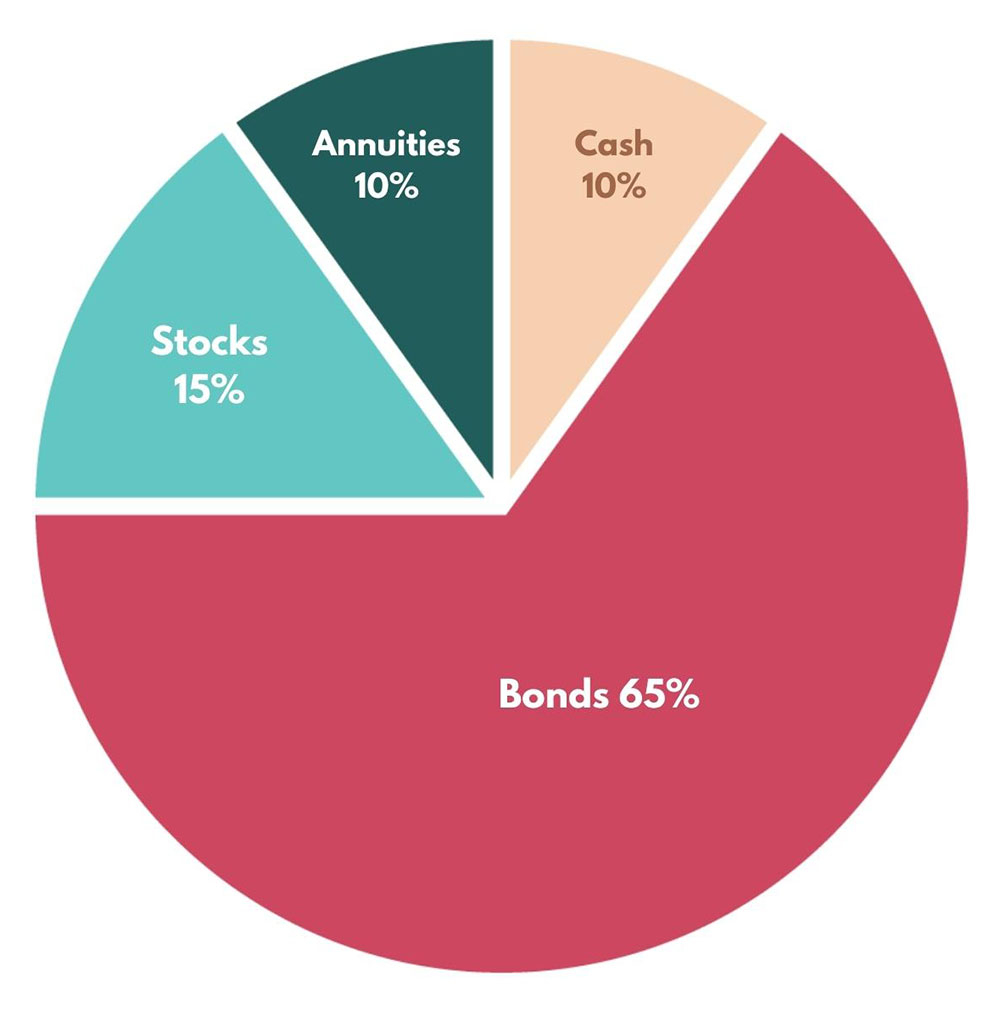

To manage your risks, you will need a well-diversified investment portfolio, which may consist of equities, annuities or Whole Life plans, bonds, etc — depending on the individual.

Here is an asset allocation representation of a pre-retiree:

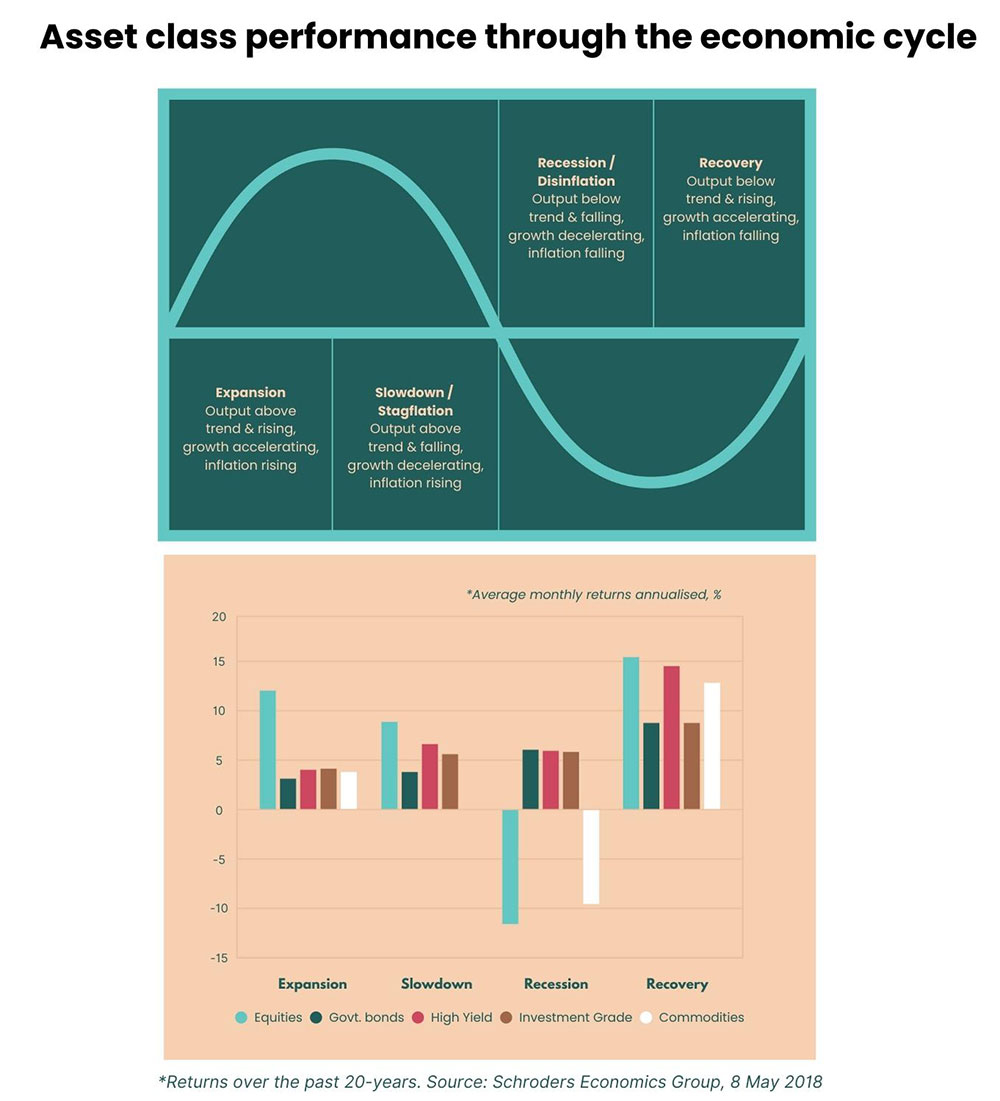

The asset allocation within a portfolio is important due to the behaviour of different financial assets during different periods of the economic cycle. For instance, stocks and bonds are usually negatively correlated. So when stocks dip in prices, the value of bonds tend to go up.

The correlations between different asset classes create opportunities for you to diversify and lower your risk, so that your returns can still be potentially optimised during any market condition.

In the case of annuities, despite any market changes, a certain amount of payouts is usually guaranteed. Thus, this product can also serve as a strategy for you to manage your risks in your investment portfolio, if you are investing in equities as well.

This is how it can be used to your advantage for its cash flow certainty – a convenient option to get high potential returns on passive income.

If the certainty of passive income is of priority to you, an annuity is a great tool you can make use of as part of your holistic investment strategy. It also can be used to manage risks due to its guaranteed income cash flow.

A licensed professional, such as a financial advisor representative, would be able to help you do the right asset allocation and regular rebalancing according to your financial goals and risk appetite, so that you will still be able to reach your goals and get consistent passive income for retirement regardless of economic changes.

Feel free to reach out to me for a complimentary financial strategy consultation (by approval only).

No financial product is perfect on its own

Most importantly, when considering any investment product for retirement, you must first understand how it works, its advantages and disadvantages. This is so that you know that you are making the best decision for yourself and your loved ones.

Till today, Gary has been very happy with the holistic investment strategy I crafted for him. It aligns with his goals, risks and expectations.

The asset allocation of a pre-retiree’s portfolio should also be designed to be suitable for the individual’s financial goals and risk appetite at that stage. If you are about to retire, you should not opt for an aggressive asset allocation strategy but instead, have a more conservative asset composition like the one above.

Your retirement portfolio should consist of assets that are able to manage the risks of any shortfall in returns, so any shortfall is within tolerable range while still getting you returns that allow you to live comfortably.

This is something a skilled financial consultant would be able to do for you.

As a Chartered Financial Consultant (ChFC®), I have planned, strategised and managed my clients’ retirement portfolios that are optimised to perform during any market conditions.

With more than 8 years of experience, I’m recognised as one of the top 1% in the financial services industry, having achieved Top of the Table ®(MDRT) in 2020, 2021 and 2022.

I have also worked with more than 100 mass affluent families to help them be on track to retire 10-15 years earlier. And I can also help you do the same.

Delaying your retirement despite having multiple assets?

What is lacking is a sound strategy with the latest solutions to optimise your assets, so you can receive multiple passive income streams. Get a complimentary consultation session now (for qualified applicants only).

Further Reading

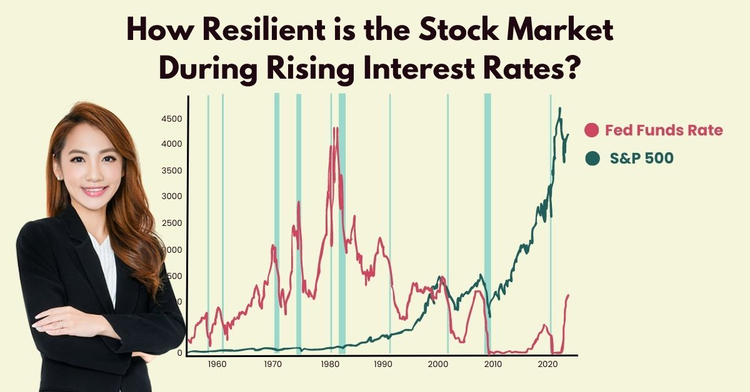

High interest rates in 2023? What are the opportunity costs if you go for short-term returns?

Retirement planning, income investing, Passive income, Investment

With current high interest rates, is it a good time to grow your cash through opportunities that can generate short-term payouts? What are the potential risks?

Copyright © 2022 TheFinLens by Jasmine Siah. All rights reserved.